What to Do When Markets Change Direction

As you are likely aware, after having broken numerous bull market records, markets are now set to break several new records—this time, in the opposite direction. The S&P 500 Index, which hit an all-time record high a little more than one week ago, has plummeted approximately 14% at a historically rapid pace. Indeed, sell-offs like this are painful, especially when they happen so quickly. (For some context, market declines approached 13% during the SARS and Zika scares.) But regardless of the reason or the speed, steep declines like these should be expected—and accepted—by all long-term investors.

Expect the Unexpected

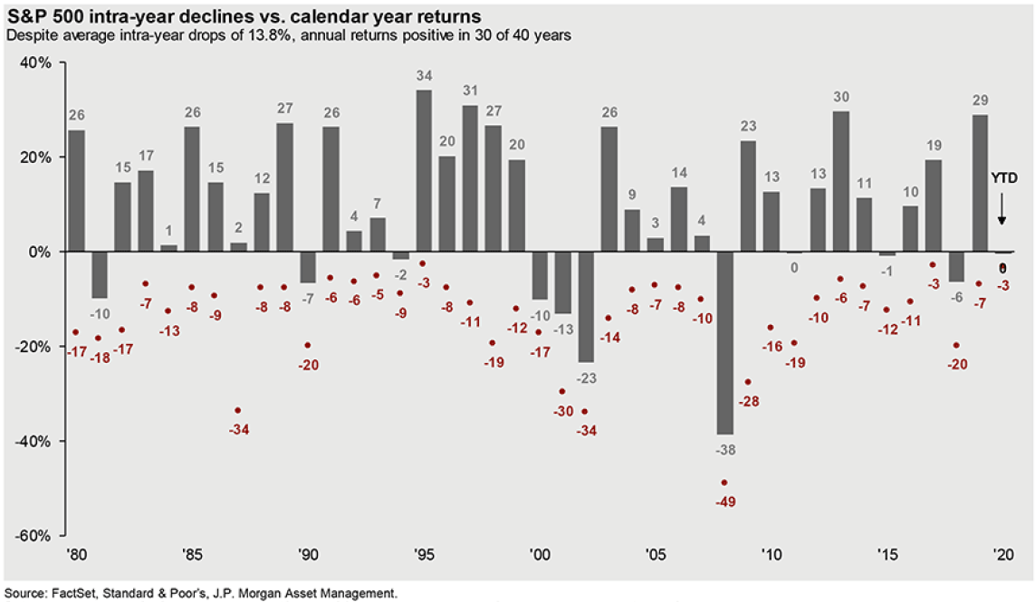

To explain why, let’s revisit one of our favorite charts. It illustrates that, on average, investors have historically experienced intra-year declines of 13.8%. Therefore, the volatility we are experiencing right now is very much in line with what we should expect! Of course, many times these declines occur over multiple weeks and months—a different kind of pain, but painful nonetheless.

We put up with these roller coaster rides because we know that, in the long run, the stock market has been more positive than it has been negative. In the past 40 years, 30 have been positive—and that’s excluding dividends!

While the recent volatility is a normal part of the market cycle, we recognize that downturns like this can shake investor confidence. Therefore, it’s important to put these events into context so that you can more confidently adhere to your long-term investment plan. Here are some important points to consider in the coming days and weeks:

- This is not the Global Financial Crisis (GFC) of 2007-2008. The current situation bears no resemblance to 2007-2008. Unlike the GFC, the market is not retreating in response to a systemic problem embedded in the global economy.

- No pain, no gain. Since the S&P 500 reached its bottom in 2009, it’s increased 377%, excluding dividends, through January 31, 2020. To earn this level of return, though, investors have had to endure volatility along the way (e.g., the 14% decline from September to December of 2018).

- There is a silver lining. For investors who own bonds, yields have fallen considerably since just the beginning of the new year, pushing global bond prices (and total returns on bonds) meaningfully higher. Not to mention that stock market declines are an opportune time to harvest losses in order to offset gains and buy more equities at lower prices.

But What if This Time Is Different?

With an upcoming presidential election, 2020 was already poised to be an emotionally charged year. The concerns about the coronavirus (COVID-19) fueled previously smoldering fires, and some investors are now questioning whether they should “stay the course.”

With respect to the virus itself, we encourage you to look to medical experts and scientists for important updates and recommendations relating to COVID-19. We will be doing the same.

But, as investment advisors, our job is to help our clients make sense of the market’s response to this outbreak. And when we examine market reactions to similar events (SARS, Zika and Ebola outbreaks, political elections, natural disasters, terrorist attacks, etc.), the data overwhelmingly suggests that investors are best off staying the course. Market corrections such as these often rebound quicker than they occur. That is one reason why our investment philosophy is grounded in a long-term strategy of disciplined, real-time portfolio rebalancing—so that our clients can capture the opportunities of a fluctuating market. This consistent approach deters us from giving in to the emotions of the moment, which often spur other investors to run for the hills.

We’re here to counsel you during stressful times and to help keep you on the path we have charted together. As always, please feel free to give us a call if you’d like to talk.