V: Establishing Effective Oversight Structures

Levels of Fiduciary Responsibility

In Pension Fund Excellence, Keith Ambachtsheer and Don Ezra describe three levels of fiduciary responsibility:

- Governing – mission and objectives

- Managing – portfolio implementation

- Operating – administration and execution

Understanding these responsibilities helps to define the roles of each fiduciary and ensure an effective governance structure.

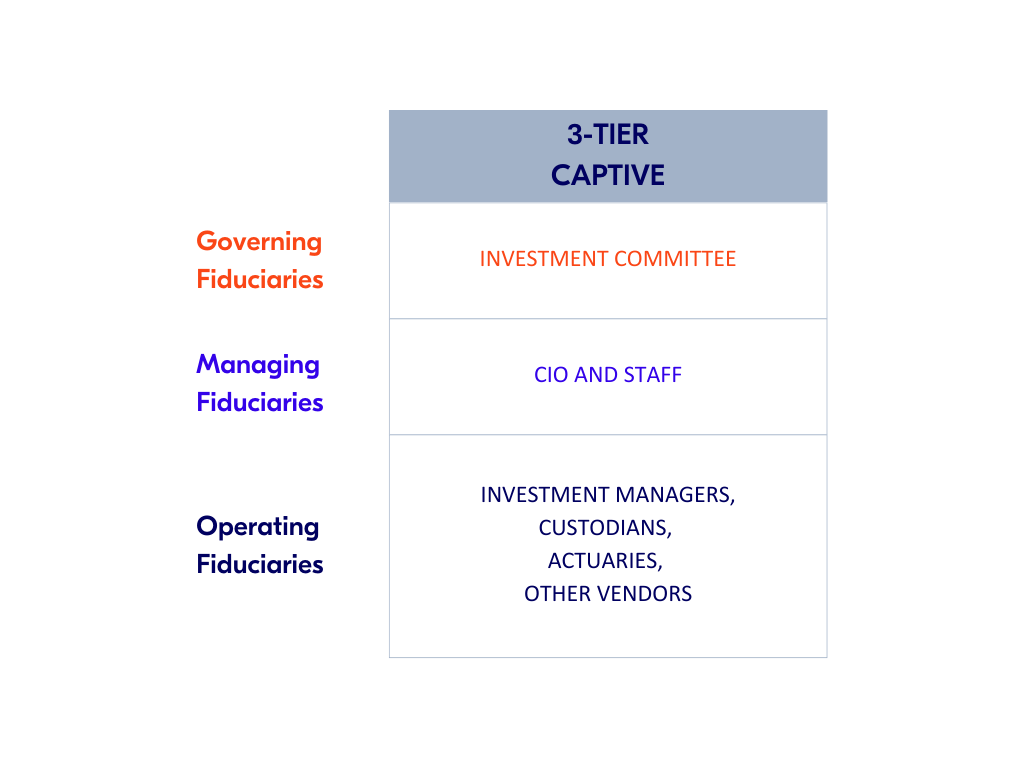

Three-Tier Captive

For many larger institutions (assets over $1 billion), the board or investment committee serves as the governing fiduciary. They establish the mission and objectives, define the liquidity and risk tolerances for the plan/fund, and set the asset allocation and investment policies.

The managing fiduciary is the chief investment officer, who determines the asset allocation within the policies established by the governing fiduciaries, selects the investment managers, and provides day-to-day supervision of the assets.

The operating fiduciaries include the investment managers, who select securities and manage the portfolios, the custodians, who hold the assets and collect dividends and interest payments, as well as actuaries, administrators, and other vendors.

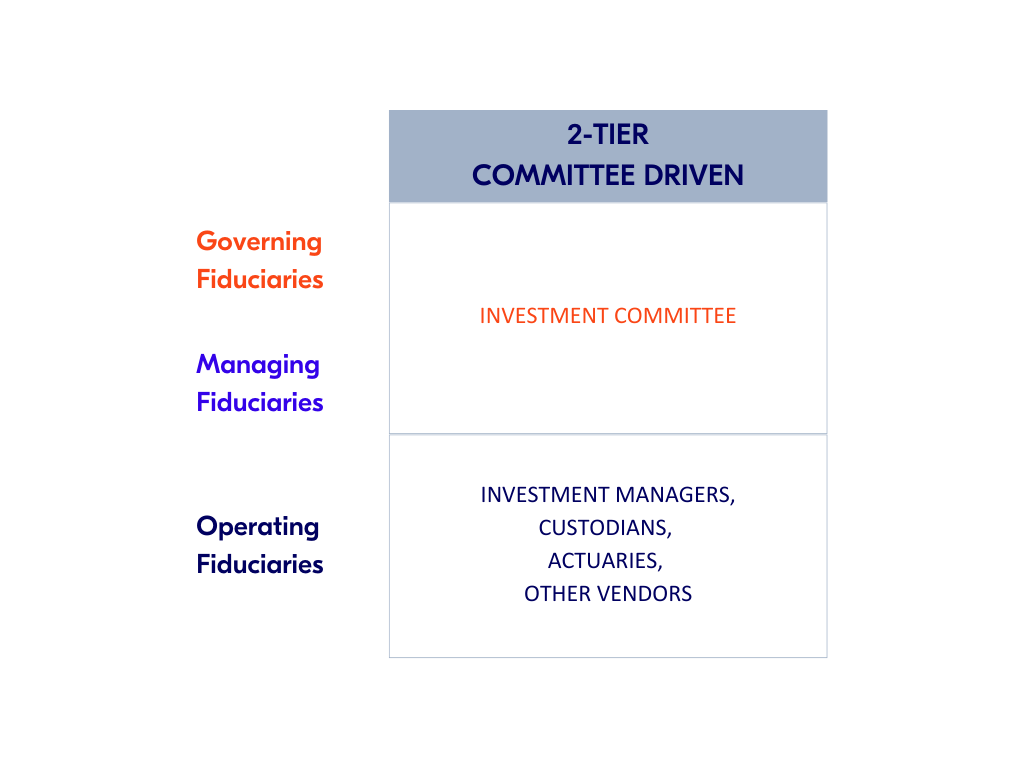

Two-Tier Committee Driven

For institutions unable to hire investment staff, a common structure is to combine the governing and managing fiduciary roles, with the investment committee serving both roles.

Thus, the investment committee sets policy and also implements decisions by hiring managers, determining the asset allocation within the policy parameters, deciding when to rebalance, and when to terminate managers.

This structure is fraught with difficulties, however, as the governing fiduciaries generally are unable to effectively evaluate themselves as managing fiduciaries.

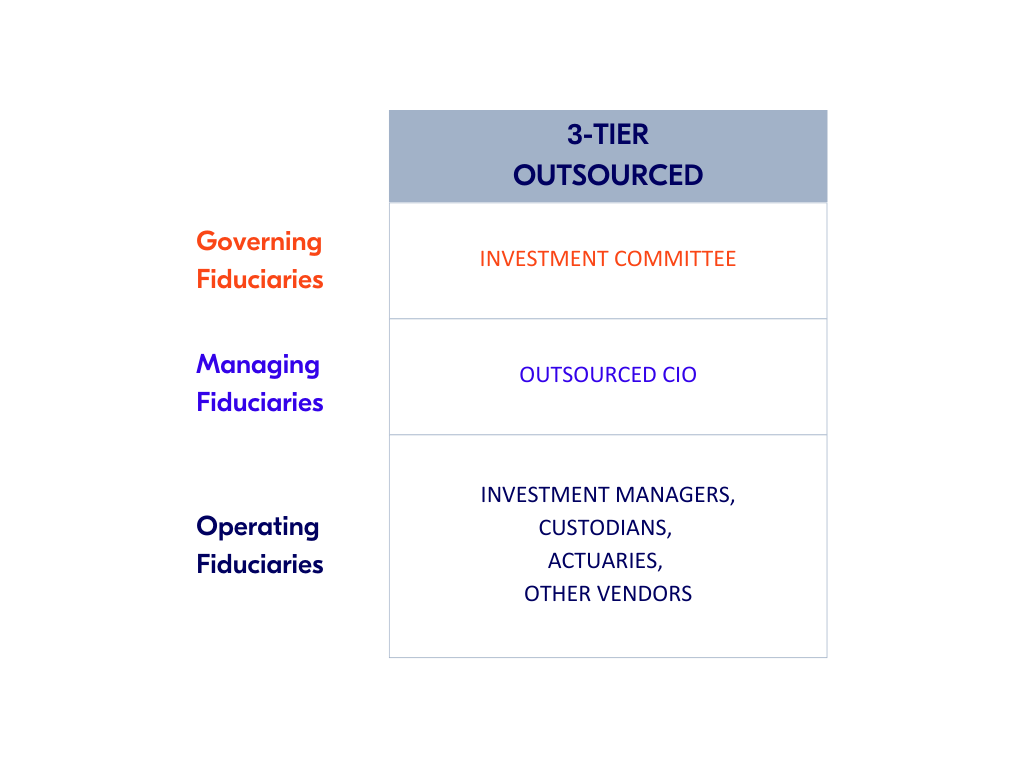

Three-Tiered Outsourced

For institutions unable to hire investment staff, outsourcing the managing fiduciary role is preferable to help overcome the challenges of the two-tier committee driven approach.

The advantage to this approach, versus the two-tier committee driven structure, is:

- Clear accountability for performance

- Increased oversight of the assets

- More disciplined decision making and efficient implementation

- Better allocation of the governing fiduciaries’ time

Clear Accountability

Under the two-tier approach, who is ultimately responsible for performance? The committee chair? The consultant? The entire committee?

The committee chair runs the meetings and sets the agenda, but has only one vote. Consultants and advisors may provide recommendations, but they are not always accepted. The entire committee ultimately is responsible, but as the governing fiduciaries, placed in the awkward position of assessing themselves as the managing fiduciaries. Thus, there is a lack of true accountability with the two-tier structure.

Outsourced investment advisory firms, on the other hand, accept this responsibility and are held accountable for performance.

Increased Oversight

Without a full-time investment department and boards/committees who meet only a few times per year, there is no one person responsible for the daily oversight of the assets. Outsourced advisory firms, on the other hand, employ investment and operational personnel, thus providing increased oversight while serving in the managing fiduciary role.

Disciplined Decision Making and Efficient Implementation

Coupled with the increased oversight and daily monitoring of the asset mix and investment managers, outsourced advisory firms can provide disciplined decision making. For example, suppose the stock market declines and bonds rally, thus moving the portfolio away from the target allocation. In this situation, the outsourced advisory firm can make the decision to rebalance the portfolio by selling bonds, which have performed well, and buying stocks, which have performed poorly. This approach can be difficult for committees to employ, as a few members may be unwilling to sell high and buy low during a difficult market environment.

Additionally, the outsourced advisory firm, with a dedicated back-office staff, can provide efficient implementation of any portfolio decisions.

Better Allocation of Time

Finally, outsourcing leads to better allocation of the governing fiduciaries’ time. By delegating the managing fiduciary role, the board/committee can spend more time on the governing fiduciary role. Too often committees are involved in the details of the investment portfolio, such as selecting specific managers and rebalancing, and are unable to spend the necessary time on the mission of the institution, defining the portfolio’s risk tolerance and long-term strategy, and establishing the investment policies that ultimately will drive the long-term success of the portfolio.

Driving Success with Effective Governance

Today’s fiduciaries oversee portfolios more complex than ever before. What may have worked years ago may not work as well today. With multiple specialist mandates, can committees still do an effective job in evaluating managers? Probably not. Can a committee with limited resources that meets four times a year be effective in allocating a portfolio? Probably not. Would a rational individual investor ever employ a structure where several friends were invited over to dinner every three months to select the mutual funds and how the individual’s 401(k) portfolio should be allocated? No.

So why do institutions employ this structure and allow committees to spend so much time on manager selection/review and tactical asset allocation? Because they believe that is how they add value, and this is often the “fun” part of the job.

To be successful, however, boards must recognize their limitations and focus more of their attention on governance, their fiduciary responsibilities, and the appropriate structure for their institutions. Consequently, fiduciaries are assessing their governance structures and seeking to improve their processes. To avoid implementation shortfall and remove the barriers to excellence, all fiduciary roles must be clearly defined. The first step is to determine the appropriate oversight structure.

For institutions large enough to hire a chief investment officer and dedicated investment staff, the three-tier captive offers the best approach. The chief investment officer is full-time, understands the institution, and is clearly accountable for performance. For those unable to hire investment staff, however, the outsourced chief investment officer approach is preferable to the two-tier approach of asking the board/investment committee to assume both the governing and managing fiduciary roles.