Things to Consider When Exercising Stock Options

The components of P&G’s compensation package can be very rewarding but also quite complex. Valuing stock options and determining when to exercise stock options can be complicated.

When we sit down as a team to evaluate a client’s P&G stock option exercise strategy, we review their situation from several perspectives. In addition to the investment valuation of the option grant, other critical components include cash flow needs, tax strategy, and projected impact on the client’s overall financial plan.

How these factors should be weighted in the stock option exercise decision will be driven by the client’s unique circumstances. Here are some of the key considerations in making this decision.

How Truepoint Determines the Value of a Stock Option

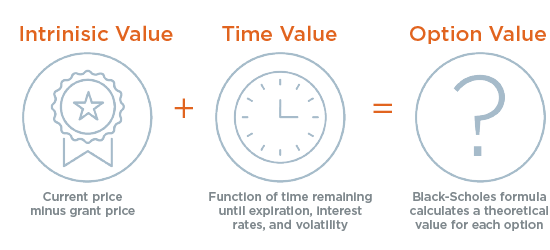

The value of a stock option is split into two distinct components: intrinsic value and time value.

- Intrinsic value is readily observable in the market—it’s the difference between the current P&G stock price and the grant price of a particular option.

- Time value is not readily observable in the market, but it is a function of the time remaining until expiration, the volatility of a stock, and general interest rates.

The Formula

The Black-Scholes formula has been used for decades in the financial industry to estimate the value of option contracts. By rearranging the equation, we isolate the intrinsic and time value for each particular option grant and then use these values to create a ratio that can gauge if the time might be right to exercise an option. This ratio expresses how much of an option’s theoretical value has been realized. When this ratio is high, most of the option’s value has been realized. At this point, investors have much to lose and less to gain from continuing to hold the option.

As useful as this ratio can be, it’s not a one-size-fits-all solution and is just one of the things we consider when determining whether or not to exercise stock options.

Understanding Your Cash Flow Needs

From a planning perspective, the first point to consider is whether an immediate cash need exists – if so, this could override all other parts of the decision-making process.

One example would be using that cash to avoid early IRA withdrawals and associated penalties. Another could be the purchase of a new home with the option proceeds contributing to the down payment. While this certainly limits flexibility and negates any further growth potential of the option proceeds, securing upcoming cash needs may be an absolute priority.

If near-term cash needs do not exist, we then consider the impact these options have on the overall financial projection. If our analysis indicates that the stock option exercise is not significant to the long-term projection, then the flexibility exists for investment evaluation, tax impact and risk preferences to drive the decision.

However, if the inflow of option income has a material impact on the long-term success of a client’s plan, this will influence our recommendation. For example, we may lower our targeted ratio if we determine that a decrease in P&G’s stock price would materially impair the ability of the client to reach their financial goals.

Additionally, if a significant portion of a client’s wealth is concentrated in P&G stock, then we could look to exercise stock options earlier to reduce overall risk to the plan.

Consider the Tax Impacts of Exercising Stock Options

We always look at the tax impact when making stock option exercise recommendations. We run tax projections to assess the impact of most option recommendations, but depending on timing and volatility, we wouldn’t let the tax considerations outweigh the investment and financial planning perspectives.

The end of a tax year can introduce greater flexibility for strategic tax planning. If a client’s income level and/or marginal tax rate is likely to decline in the next tax year, the small timing risk of deferring exercise could result in significant tax savings. But we can calculate how much the stock would need to fall to negate the tax benefit of waiting until the next tax year and assess the risk of waiting.

However, the more time between potential exercise and the end of the tax year, the more we will rely on the valuation ratio and the financial planning variables to make a recommendation.

At Truepoint, we strongly believe in a fully-integrated approach when it comes to wealth management, especially bringing in a tax and estate planning mindset. Whether receiving equity compensation from P&G or from another employer, each client we work with has unique circumstances, based on their own compensation package, as well as their own goals for retirement. But it’s important to view this one part of compensation as a piece of the larger financial strategy and not in isolation.

We have a depth of experience working with clients whose plans involve equity compensation from companies including Procter & Gamble, GE, Johnson & Johnson, Google, Microsoft and more. While this piece highlights our general process, every situation is unique and may necessitate a different approach.

Click here to schedule time to tell us about your unique situation and find out how we can help you make the most of the advantages offered to you through your equity compensation package.