Year in Review 2022: Volatility Dominates the Markets

“As you are likely aware, after having broken numerous bull market records, markets are now set to break several records—this time, in the opposite direction. The S&P 500 Index, which hit an all-time record high a little more than one week ago, has plummeted approximately 14% at a historically rapid pace. Indeed, sell-offs like this are painful, especially when they happen so quickly. But steep declines should be expected—and accepted—by all long-term investors.”

Although this analysis feels eerily relevant today, it actually comes from our March 2020 commentary. It struck us as noteworthy because in many ways 2022 followed a similar trajectory and produced similar anxieties among investors. The S&P 500 hit an all-time high in January 2022 but ended the year with its worst annual performance since 2008. This year was also a rare instance when both bonds and stocks produced negative returns, making it harder for investors to find a safe haven. Plus, historic levels of inflation cut into consumers’ purchasing power. It can feel intimidating and even scary to stay the course despite all these negative signs.

Looking back at March 2020—at the beginning of an unprecedented global pandemic and a significant drop across markets—can help shed light on today’s environment. It would have been understandable then to expect that the markets would remain depressed throughout the pandemic. Yet, shortly after we wrote that commentary, the market enjoyed one of its fastest rebounds in history. On the heels of a 34% decline in the S&P 500 from February 19, 2020 to March 23, 2020, the U.S. stock market returned to precrash levels by July and then hit a new all-time high in August 2020, even as global economic data remained troubling.

The market’s response to the pandemic underscores two important—and related—lessons of investing: (1) the market is not the economy; and (2) while economic data looks backward at what’s already happened, market returns project forward.

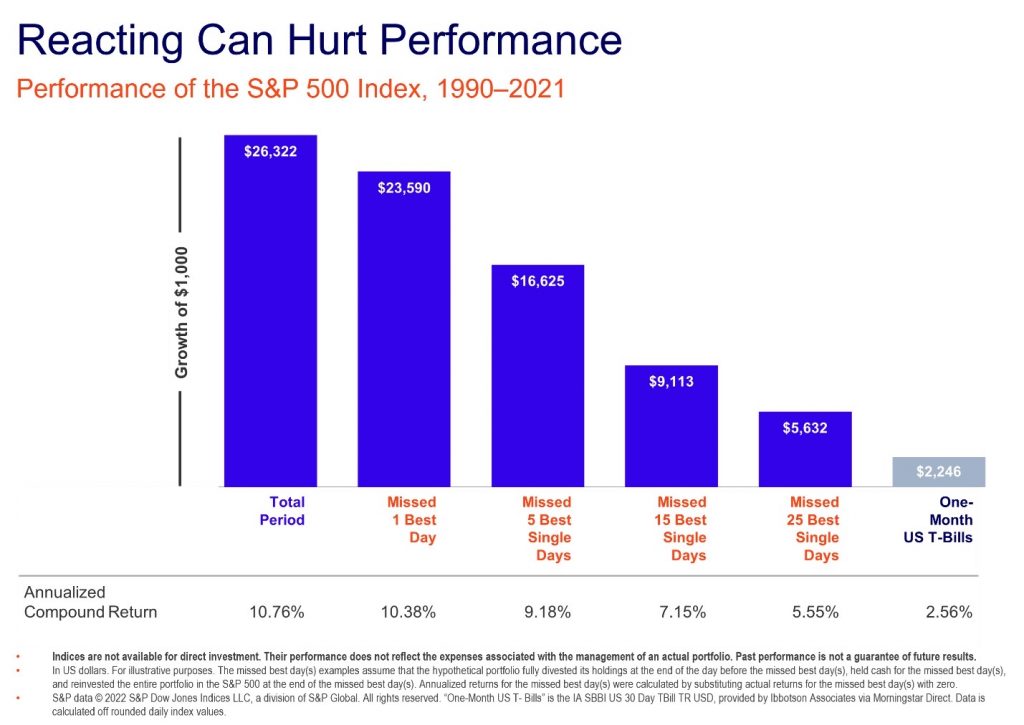

When downturns like these occur, it can feel wise to retreat to the sidelines until signs of brighter days appear. However, because economic data looks backward and markets look forward, the market almost always rebounds before economic data does. Additionally, it is incredibly difficult, if not impossible, to determine what sign points to better times ahead. So, when investors try to sit out a downturn, they usually sell when prices are at their lowest and then miss out on at least some of the subsequent recovery, which can significantly erode their overall performance. The chart below shows just that; missing the five best single days in the market from 1990 through 2021 would have reduced your annualized return by about 1.5% per year. This past year has been no exception, with the highest, single-day return for the S&P 500 in 2022 being 5.55%.

This is not to minimize the pain caused by market downturns. Yet the goal of long-term investors is not to generate positive returns for a six-, twelve-, or even eighteen-month period. Instead, they seek to generate superior returns for multiple years, if not decades. Short-term downturns, while painful, are an inherent and unavoidable part of investing.

As the chart above indicates, investors do better when they adhere to a rational, disciplined approach that is not driven by gut feelings and headlines. A good long-term plan accounts for market downturns and recognizes that no one knows precisely when markets will rebound. It uses historical data to set target allocations and dynamically rebalances when allocations drift too far from their targets.

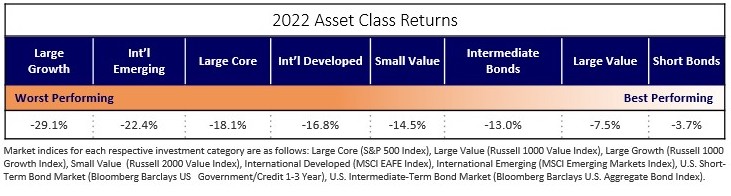

This helps to explain why—even during a down year for the markets, like 2022—Truepoint’s portfolio generated strong relative performance, compared to market indices and benchmarks. In particular, our stock returns were helped by our tilt toward value stocks and our broad exposure that included developed international markets, two categories that brought diversification benefits to our client portfolios in 2022. We do not know from year to year which asset categories will perform the best. Instead, we recognize that no momentum can last forever: growth stocks were not always going to outperform value, and U.S. stocks would not dominate international stocks indefinitely. That is why our investment philosophy is grounded in a long-term strategy of broad market exposure across all asset classes and disciplined portfolio rebalancing—so that our clients can capture the opportunities of fluctuating market dynamics.

Looking Back to See Forward

As we head into 2023, the investing environment appears more in line with historic norms than it did at the start of 2022.

- After years of unprecedented heights, U.S. stock valuations have returned to average levels.

- Although inflation remains high, data indicates that it is steadily slowing.

- Interest rates are no longer being maintained at uncharacteristically low levels, and bond yields are once again increasing.

More normal conditions do not mean that all of the bad news is behind us. We expect the Federal Reserve (Fed) will wrestle with some conflicting data, specifically around jobs, wages, and inflation, which were also areas of concern throughout 2022. But we also expect that market returns will improve ahead of economic data, as they typically do, including after the COVID-19 sell-off and the global financial crisis of 2008.

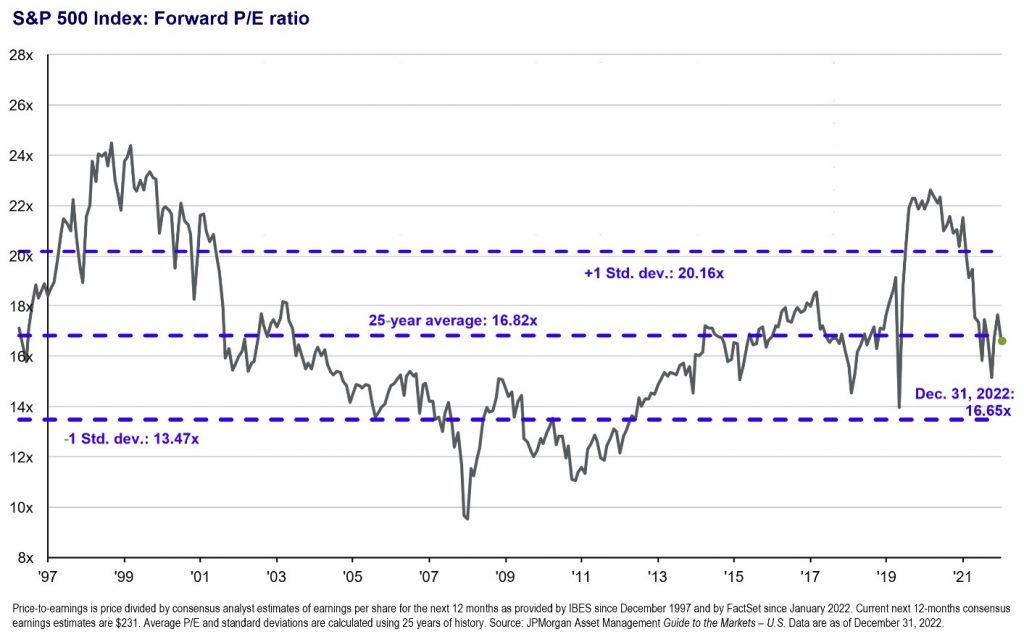

U.S. Stock Valuations Revert to Historic Averages

A recession could still happen, but keep in mind that stock prices usually fall before a recession even begins. Stock prices dropped significantly in 2022, demonstrating that the market has already priced in some risk of recession. While the downturn in prices was significant, this movement also brought stock valuations more in line with their historic average. At the end of December 2022, the forward Price/Earnings (P/E) ratio for the S&P 500 was 16.7x—approximately its 25-year average. In contrast, in December 2021, the S&P 500 forward P/E ratio was about 22x, indicating that the U.S. stock market was trading above its historic valuation. As you can see in the graph below, it is not uncommon for the market to trade above historic valuation for periods of time, and this does not necessarily mean that stocks as a whole are overvalued. Valuations can also be high when market sentiment is positive, and investors are willing to pay more for current earnings because they expect future earnings to grow. The reverse can be said when the market is trading below historic valuation. Today’s valuations imply that investors are neither overly bullish or bearish on the direction of the market.

Interest Rates Hikes Are Slowing Inflation and Increasing Bond Yields

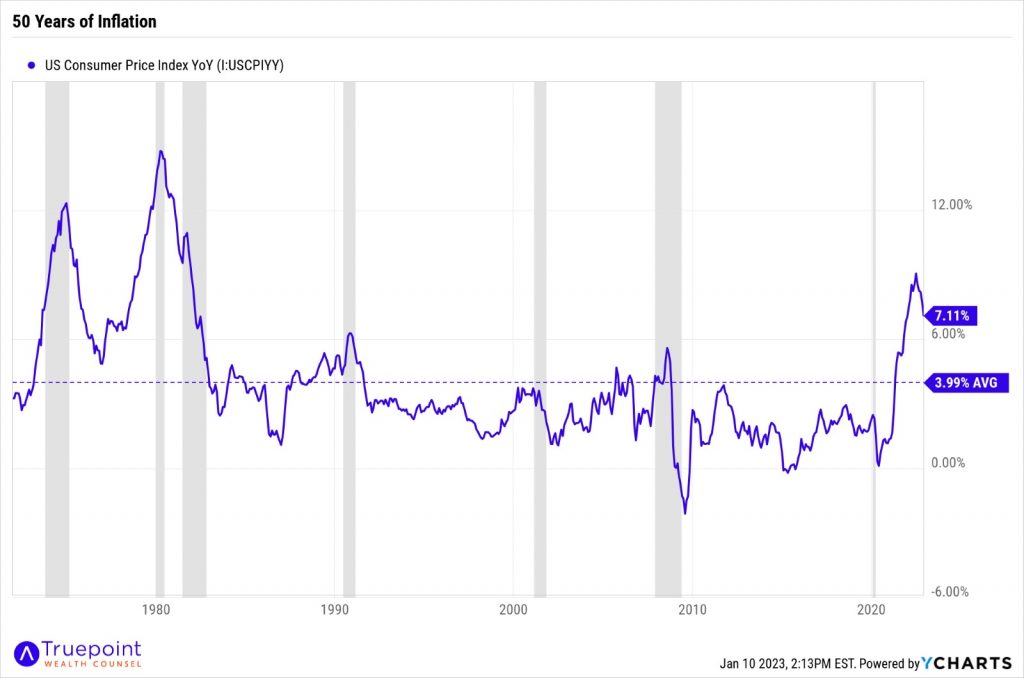

Although inflation has dogged consumers and worried investors, the Fed’s interest rate hikes have begun to produce their intended effect, and headline inflation numbers, like the Consumer Price Index (CPI), appear to be heading in the right direction. Headline CPI reached a peak of 9.1% in June 2022, but with the most recent reading on January 12, 2023, inflation has since fallen to a 6.5% annual rate, inching closer to the 50-year average of 4.0% and the Fed’s target of 2.0%.

Interest rate hikes have also increased bond yields, making potential bond returns attractive. A portfolio of high-quality bonds, such as Treasuries and investment-grade corporate bonds, can now yield approximately 4-5% without taking excessive risk that would have been necessary to achieve those yields a year ago. Today, market commentators are routinely speculating about whether—and to what extent—the Fed will raise rates in 2023. Yet, as we discussed in May 2022, despite the Fed’s importance, it is only one of the many market participants whose actions affect the yield curve. Investors should keep the Fed’s influence on investment returns in perspective.

Uncertainties Continue to Linger

Undeniably, several uncertainties hang over the U.S. economy today, including inflation levels, interest rate hikes, and supply chain issues, as well as broader geopolitical concerns, like the war in Ukraine and the course of COVID. Worrisome economic news like this can prompt investors to act on some of their worst impulses—tempting them to believe they can wisely sit out the downturn until the exact inflection point reveals itself. Because economic data is necessarily backward looking, however, this is like using the rearview mirror to drive your car. Market prices, on the other hand, focus on future earnings, and today’s prices are already factoring in these risks.

The belief among some investors that uncertainty is higher now than it was in the past is a curious one. It implies that the future used to be more predictable— before inflation rose, interest rates spiked, and the war broke out. Of course, that isn’t the case. There are always risks. But when times are good, people either prefer to be blind to those risks or simply choose not to ponder the endless scenarios.

The future is always unpredictable. And those who exit the market until they see proof of brighter times ahead risk missing out on some of the strongest gains and work against their long-term goals. Even with the global pandemic and the significant downturn in 2022, if you had remained invested in the S&P 500 from January 2020 through December 2022, you would have earned a cumulative return of 25% and an average annual return of 10%—a handsome tradeoff for your patience and discipline. Without a crystal ball, staying invested is the only way to maximize your benefits from the market recovery and the economic turnaround.