The More Things Change, the More They Stay the Same

Throughout the quarter, the markets, across all regions and asset classes, dropped sharply on several days—and occasionally on several consecutive days. On Friday, March 23, the Dow Jones Industrial Average closed at 23,533—its lowest since November 22, 2017. Investors reacted swiftly and negatively to Trump’s proposed steel tariff and the potential for a prolonged trade war between the U.S. and China. As the quarter came to a close, however, the reports of closed-door talks between the two countries inched markets upward.

This scenario is one that we see play out frequently—unpredictable events, especially political ones, can disrupt short-term performance, but often the markets absorb the change and then carry on. And, as we pointed out in our 2017 annual letter, calm markets like we experienced last year are actually the deviation, not the norm.

Volatility, Uncertainty, and Opportunity

Although everyone tends to think of “volatility” as something negative, when it comes to investing, it actually can produce opportunities. As this quarter’s roller coaster shows, stock prices can fluctuate without much justification or rationale. It is this volatility in stock prices that gives us the ability to “buy low” as we rebalance into stocks at a discount.

At Truepoint, we rebalance our portfolios in real time so that we can capture the opportunities that a fluctuating market provides. This disciplined approach means that we do not react to market swings with defensive, short-term measures. Instead, we actively plan for market volatility and see it as a way to build on our long-term returns.

Despite the noise in the markets, most economic indicators point to expanding economies in the U.S., Europe, and China. Thus, the general market consensus is that the long bull market can continue, albeit with some down periods here and there. This view rests on two premises: that the U.S. economy will keep growing and that the Federal Reserve won’t be pressed to fight inflation through aggressive rate hikes.

Passive Investing and Over Exposure

At the end of February, the five biggest components of the S&P 500 were all technology stocks: Apple, Microsoft, Amazon, Facebook, and Alphabet (formerly Google). During that time, those five stocks alone made up nearly 15% of the S&P’s market value—more than the entire financial, health care or industrial sectors.

This heavy tilt toward a few names is referred to as “concentration risk,” and it can have significant implications for investors. Although index investing can provide broad diversification at a low cost, the actual amount of diversification achieved can vary widely. For example, investors today who are holding a substantial amount of assets in an S&P 500 index fund may think they are diversified, but in fact, their assets are strongly connected to the fates of just a few companies—and to just one industry, technology.

To be clear, we are huge advocates of index funds. They have become a powerful and important tool in many investors’ portfolios. But the concentration risk in the S&P 500 today illustrates why many individual index funds should not be used as standalone investments.

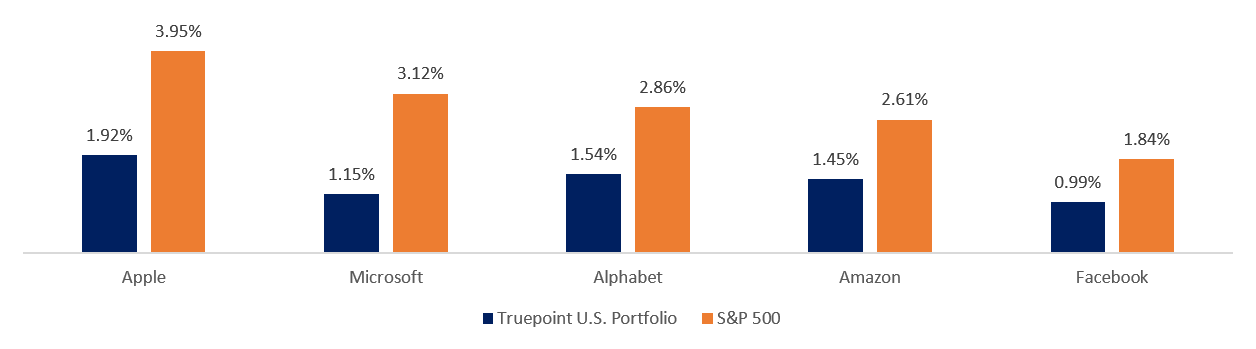

For example, when we compare Truepoint’s U.S. holdings to the S&P 500, the distinction in weighting of those same five technology stocks is clear (data as of February 28, 2018):

As you can see, these holdings comprise only 7.1% of our total portfolio—less than half the overall weight within the S&P 500—which means our clients’ returns are not so reliant on just a few tech-based companies.

Location, Location…Interest Rates?

Another notable distinction of our portfolio is our allocation to the real estate sector, including Real Estate Investment Trusts (REITs). In 2017, this sector returned in the high single digits, which is respectable overall, but a relative disappointment in light of last year’s strong market. This year, it is also lagging behind other sectors, down 7% year-to-date—at the bottom of the pile.

The most common explanation for the underperformance is the interest rate environment – specifically, rising rates. Although there is a great deal of research on the relationship between interest rates and REITs, much of it is conflicting and focused on short and specific time periods.

Today, interest rates are rising because of concerns about increased inflation, and real estate typically performs well during inflationary periods. Rent prices rise along with the cost of living, and demand for offices, warehouses, and apartments increases. This in turn drives up REITs’ earnings, which more than makes up for the higher costs that rising interest rates produce.

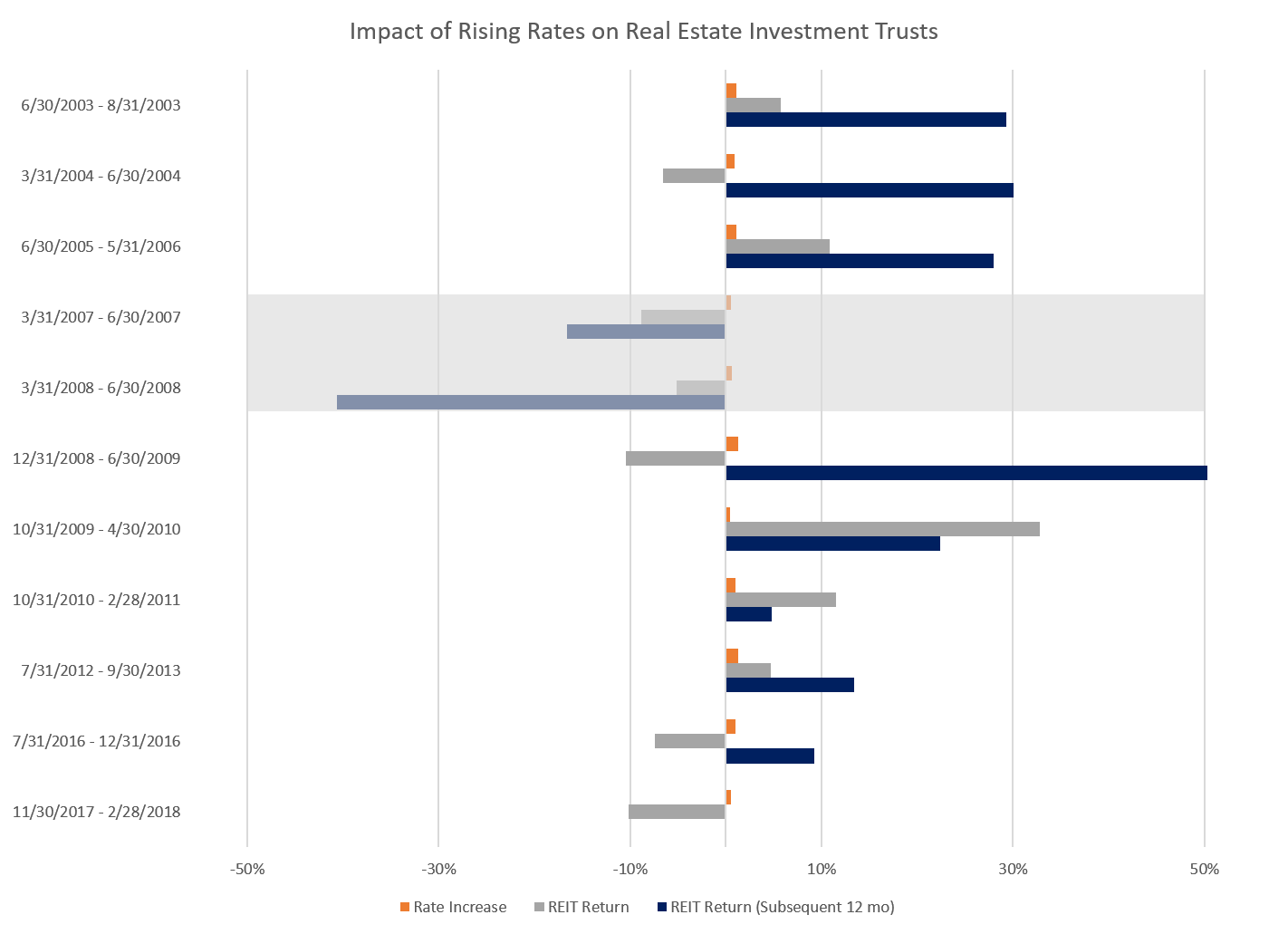

The data below demonstrates how REITs have historically performed, relative to rate increases. The figure highlights every period over the past 15 years when the ten-year U.S. Treasury rate climbed in three or more consecutive months. If we remove the two periods during the global financial crisis (shaded in the illustration), half of the time REITs enjoyed positive returns during those periods. More importantly, in every case, for the next 12 months, REITs produced positive returns —and often those returns were solid.

Our Commitments

Our approach to investing—whether it be our real estate allocation or response to the news of a potential trade war—remains the same. We maintain a long-term view and do not get distracted by the noise of short-term market adjustments. There will always be a headline of the day.

But we designed our investment process to capture opportunities across all market environments, and we execute that process with discipline and consistency. We can’t predict when or how conditions will change again, but we can promise you that they will. And we can promise you that we will—still—be ready for it.