The Clarity of Hindsight and Expectations for 2016

The year 2015 has come to a close, and most balanced portfolios (70% stocks and 30% bonds) ended the year relatively flat. Although portfolio values changed little from the beginning of the year, there were plenty of forces at work influencing the markets over the last twelve months. Here are the four major themes that had an impact in 2015:

- The strengthening US dollar (USD)

- Falling commodity prices

- The slowdown in China

- The Federal Reserve’s changing monetary policy

In this investment commentary, we’ll review how each impacted the portfolio in 2015 and comment on how we think these dynamics could contribute to the markets in 2016 and beyond.

Dollar Drag

The USD appreciated 16% relative to major world currencies in 2015, which had a negative impact on US companies with foreign exposure. In fact, nearly half of the revenue of companies in the S&P 500 comes from outside the US. The stronger dollar decreased earnings of these companies by about 6%.

Just as the appreciating dollar weakened earnings of US companies selling goods and services overseas, US investors owning foreign stocks took a similar hit when translating their returns back to the dollar. In local currencies (i.e. the foreign company’s home currency) foreign developed stocks returned +4%, however, when converted into US dollars terms the return was -3%. In other words, the strengthening USD lowered returns for US investors by 7 percentage points. The drag on emerging markets was even larger: emerging countries posted a -6% return in local currencies as opposed to -15% in US dollar terms, a currency drag of 9 percentage points.

Falling Commodity Prices

Crude oil prices, above $50 a barrel at the beginning of 2015, ended the year below $40 per barrel, the lowest level since 2009. Commodity prices are the result of supply and demand, and while the global growth in oil demand did not change, a rapid growth in oil supply around the world led to lower oil prices.

Lower commodity prices negatively impacted several countries, specifically in emerging markets, that rely heavily on revenues from oil production. In the US, the energy sector historically contributes 12% to the overall earnings of companies listed on the S&P 500. In 2015, primarily as a result of falling oil prices, the contribution was -1%. For many emerging market countries, falling energy prices not only resulted in lower earnings, but also caused these countries to enter into recession.

The China Effect

The deceleration of China in 2015 was a headwind for global stock markets, and in particular, emerging markets. While direct stock investments in Chinese companies only approximate 1% of Truepoint’s 70/30 (stock/bond) portfolio, China’s slowdown has had a more far-reaching impact on global growth.

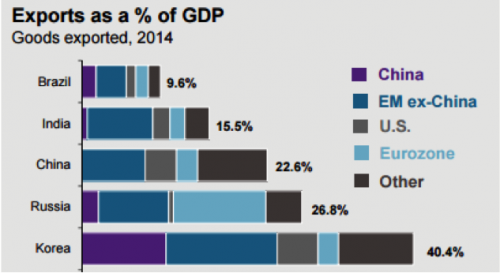

As illustrated in Figure 1, emerging countries are highly dependent on China as a trading partner, and China’s slowdown had a significant impact on export volumes of these nations.

Figure 1

Anticipating the Fed

On December 16, 2008, the US Federal Reserve (Fed) cut the target federal funds rate to a range of 0-0.25%. Seven years later, the Fed elected to lift the target interbank lending rate range to 0.25-0.50%. Perhaps surprising to some investors, after the announcement US stock markets responded with a strong rally to finish the trading day.

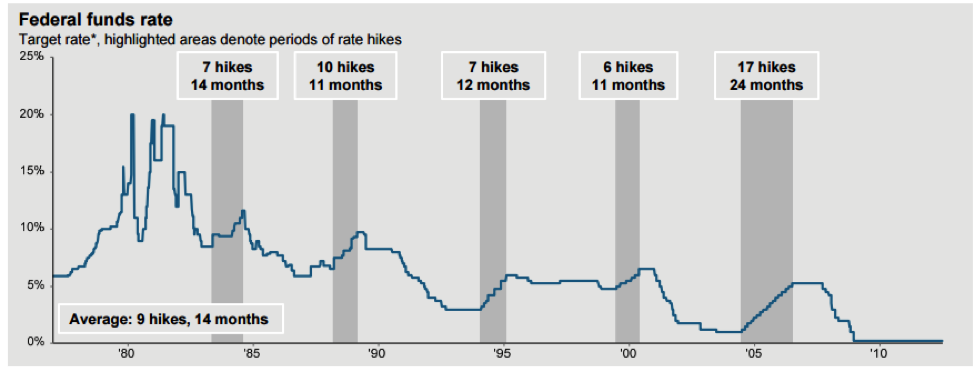

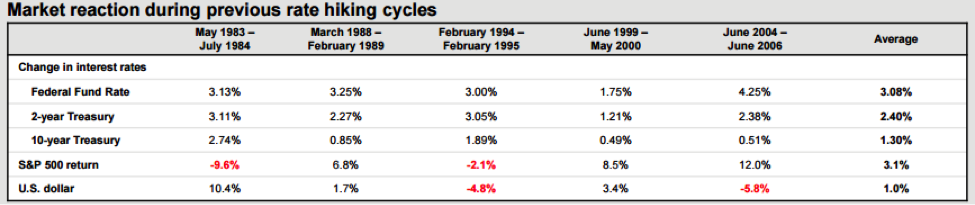

Why the stock rally? If history can be used as a guide (see figure 2), a modest interest rate increase often proves to be a positive force for US equities – note that on average, the S&P 500 return was positive (+3.1%) during previous Fed tightenings, and only negative when the 10-year Treasury rate increased by more than 1 percentage point. Perhaps the best explanation for this reaction is that the market views the Fed’s willingness to raise rates as a vote of confidence for the economy to be able to withstand a more restrictive policy.

Despite a slight increase in interest rates throughout 2015, Truepoint’s bond portfolio fared well, posting positive returns for the year.

Figure 2

Looking Ahead

There was no shortage of worries for investors in 2015, and 2016 will likely be no different. Although foreign stocks did not perform as well as US stocks over the past three annual periods, we must keep in mind the long term as well as the benefits of diversification. No asset class is more attractive today on the basis of fundamental valuation than emerging markets. Should China’s situation improve, the dollar depreciate or even stabilize versus emerging currencies, and/or commodity prices recover, the emerging markets could be well-poised for a comeback.

With the Federal Reserve finally raising their benchmark lending rate above zero, the United States has officially begun a period of tightening monetary policy. In contrast, the Eurozone continues their version of quantitative easing with the intent to reinvigorate their economy. Should these two policies continue to diverge, foreign stocks may benefit versus their US counterparts, strengthening the benefits of international diversification.

Bond investors can rest easy knowing that their high-quality fixed income portfolio has limited exposure to rising interest rates, and should the Fed stand by their message of a measured interest rate increase, the increasing income component of their bonds should more than make up for any decrease in bond prices, providing positive total returns.

Only in hindsight can we clearly understand what the major influences were on stock and bond returns. For this reason, we continue to find conviction in our “all-weather” portfolio – one that has a prudent mix between growth (US, foreign stocks, and real estate investments) and safety: short-term, high-quality fixed income. We believe that our intellectually honest and balanced approach should serve our clients well over the long-term, no matter what surprises 2016 may bring.