Joy in the Journey

This series takes an innovative, modern, and tailored approach to financial planning and is designed to help you craft a unique strategy that focuses not only on wealth but also on discovering a deep and sustaining sense of fulfillment. Drawing on principles from Maslow’s hierarchy of needs, we will cover issues like finding a purpose, embracing the unknown, and how to develop empathy and acceptance as we consider the question “what’s the point of it all?” To read other pieces from the series, click here.

In this installment, we’ll highlight the importance of enjoying your life’s journey—professionally, personally, and financially—instead of hyper-focusing on a distant and uncertain future.

The Summit… Or the Ascent?

“It’s kind of funny. The actual achievement doesn’t really change your life like you think it might, but what you’re left with is the journey that got you to that point.”

This journey-focused perspective is encapsulated succinctly and powerfully in the Netflix documentary The Alpinist, which follows the free solo climber Marc-André Leclerc. Leclerc spends a great deal of time training and preparing for his momentous and impressive climbs. You might think that the climbs themselves have outsized meaning for him, that they represent a culmination—a literal pinnacle—of his accomplishments. But, Leclerc points out ironically, “It’s kind of funny. The actual achievement doesn’t really change your life like you think it might, but what you’re left with is the journey that got you to that point.”

Research backs up Leclerc’s words of wisdom. For example, several studies have shown that people in their 60s are happier than those in their 40s. As we age, our levels of stress, anxiety, and anger all decrease, and our positive emotional experiences increase. This may sound counterintuitive. Why would growing older make us happier?

Psychologist Laura Carstensen, Director of the Stanford Center on Longevity, has discovered that people tend to feel more happiness when they focus on shorter time horizons, rather than always delaying gratification for the distant future. She points out that goals are set in temporal contexts.

“As you grow older and your time horizon shortens, you tend to focus more on living in the moment, ignoring trivial matters, knowing what’s important, investing in sure things, deepening relationships, and savoring life—activities that ultimately lead to greater happiness.”

When your time horizon is long, you focus on activities like preparing for the future, acquiring knowledge, meeting new people, taking risks, and exploring. As you grow older and your time horizon shortens, you tend to focus more on living in the moment, ignoring trivial matters, knowing what’s important, investing in sure things, deepening relationships, and savoring life—activities that ultimately lead to greater happiness.

A Happier Perspective

But you don’t have to wait until you’re older to benefit from this perspective. A recent Harvard study shows that people of all ages benefit from living more in the moment. Researchers pinged participants’ phones throughout the day to ask what they were doing, how happy they felt, and whether they were thinking about their current activity.

The study found that participants were happiest when they were deeply engaged in the present moment, specifically when exercising, having a compelling conversation, or making love. In contrast, they reported the least amount of happiness when they were resting, working, or using a computer. Yet, regardless of what activity they were engaged in, participants reported the most happiness when they were focused on their current activity, rather than letting their minds wander. Furthermore, researchers discovered, that mind-wandering was generally the cause, not the consequence, of their unhappiness.

“Focusing on the short term” and “finding joy in the journey” might sound like strange advice coming from your financial planner. After all, financial plans are built around long-term goals–planning for retirement, paying for children’s college, crafting a long-lasting legacy. So much of the focus is to “save for the future” without paying much attention to the life you are leading today.

But, of course, life is uncertain. There are no guarantees that we will actually reach these destinations for which we plan. A child may skip college. A medical diagnosis can drastically alter retirement plans. An extreme example of the pitfalls of delaying gratification and exclusively planning for far-off goals can be found in the “FIRE” (Financial Independence Retire Early) movement. Many devotees to this philosophy adopt a relentless approach to budgeting and frugality, denying themselves short-term indulgences for the sole goal of early retirement. Many find this level of discipline unsustainable over time. But another shortcoming is that it requires devoting all of your resources to a distant goal—and one that may not arrive.

The Life You Want, Right Now.

Although FIRE acolytes are an extreme example, the mindset can be quite common to financial planning approaches. Many high-net-worth individuals are high achievers who are accustomed to a fast-paced, intense professional environment that relentlessly focuses on long-term goals and strategic planning. But as research has shown, you will actually feel more fulfilled if you use your resources today to create the life you want right now. The far-off destinations you’re planning for might not ever come, and even if they do, they may not look how you expect.

Finding joy in the journey allows you to feel fulfillment whether or not you arrive at a specific destination because you will already be satisfied with who you have become and the experiences you’ve had along the way. Satisfaction is no longer pinned on one culminating event, but can instead be found internally and in the day-to-day joys of experiencing one’s life.

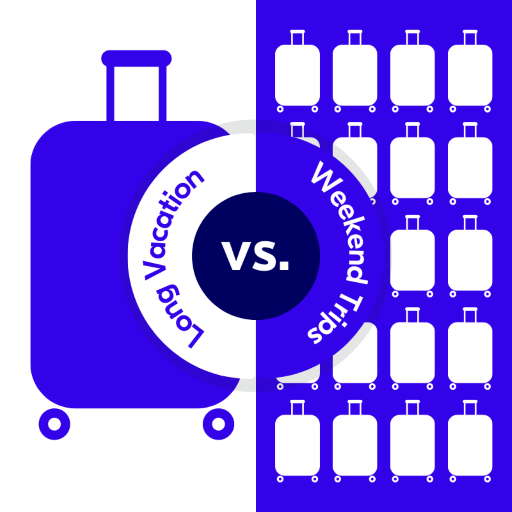

How does this apply, practically? A simple example of this is realizing that weekend trips make people happier than long vacations.

When long, infrequent vacations are replaced with shorter, more regular ones, the excitement of anticipation is multiplied and the possibility for disappointment is decreased as one’s hopes are no longer pinned on one limited experience.

Shorter, more frequent trips help you enjoy the day-to-day rather than feeling that you’re always delaying gratification into the future.

By this same method, you might adjust the time horizons for some of your other goals, giving yourself the opportunity to both plan for the future and appreciate and find meaning in the present moment.

This lesson often comes into sharp relief for those first entering retirement. We have found that many people have a very clear sense of what they are retiring from, but less of a vision of what they’re retiring to.

They look forward to the change of pace, but the sudden downshift can throw them for a loop and leave them feeling listless and unfulfilled. As one of our clients quipped, “Playing golf whenever you want fills up about a year of time. Then, you’re like, ‘OK. Now what?’”

As life expectancy has increased, the retirement phase of life has also extended and taken on new significance. Now people see retirement as the opportunity to create a life of more meaning and fulfillment, free from the daily demands of climbing the career ladder. Rather than viewing life as just two chapters—“work hard” followed by “don’t work hard”—we encourage our clients to seek joy in the day-to-day, regardless of where they are in their journey.

Read the previous installment of “What’s the Point?” here.

Truepoint Wealth Counsel is a fee-only Registered Investment Adviser (RIA). Registration as an adviser does not connote a specific level of skill or training. More detail, including forms ADV Part 2A & Form CRS filed with the SEC, can be found at TruepointWealth.com. Neither the information, nor any opinion expressed, is to be construed as personalized investment, tax or legal advice. The accuracy and completeness of information presented from third-party sources cannot be guaranteed.