Active v. Passive: What Really Matters to Investors

For several decades investors have debated the merits of “active” versus “passive” investment approaches, and there are many well-documented arguments for each. In this Viewpoint, we discuss the nature of these labels, the drawbacks to active management, and what we believe to be the best approach for investors.

What’s in a Word?

Most would conclude that a word like “active,” with synonyms such as “engaging, energetic, dynamic,” would be preferable to “passive” with synonyms such as “submissive, unassertive, docile.” The assumption is when we are active we are doing something, hopefully productive, but when we are passive, we are not involved in any activity, and therefore not productive.

In terms of investing, active managers rely on research and personal judgment to determine what securities to buy, hold, and sell. This approach is based on the conventional wisdom that by identifying mispriced securities, investors can outperform the overall market or index. Passive managers, on the other hand, minimize cost by holding a basket of stocks in proportion to their weights in a predetermined index. Passive, or index, investors do not attempt to trade around their beliefs on mispriced securities, but rather rely on the belief that disciplined ownership of a broad basket of stocks will prove the most profitable long-term strategy.

Thus, in the context of investing, these definitions can be somewhat misleading, as “passive” does not necessarily denote being submissive or lacking involvement. Rather, passive investors actively decide to forgo stock picking and market timing in favor of reliably capturing market returns, while minimizing expense and taxes. Evidence supports the belief of these investors that they will outperform most active managers due to the inherent drawbacks of an active approach.

Drawbacks of Active Management

What are these drawbacks? Specifically, we recognize the following:

- Most active managers underperform their stated benchmarks

- We cannot rely on past performance to identify outperforming managers beforehand

- To gain any advantage with active management (if even possible) requires extraordinary patience

Most Active Managers Underperform

Collectively, all investors compose the market and therefore the “average” manager will generate a return equal to the market return before fees and expenses. Assuming fees and expenses are 1% (they are often higher than this), an active manager must outperform the market return by a full 1% simply to match the market return net of fees.

An additional consideration is the theory that markets are efficient and stock prices reflect all relevant information. If this is true, then active managers are unable to truly identify mispriced securities and any outperformance is likely the result of luck rather than skill. This logic would also hold true for underperforming managers, indicating they did not lack skill, but were unlucky.

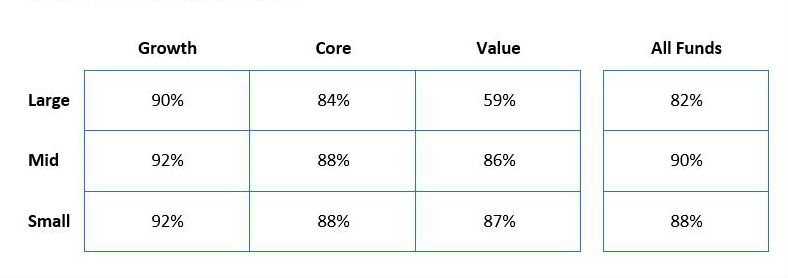

Although academic arguments are interesting, what do the results indicate? Standard & Poor’s reviewed the performance of actively managed mutual funds versus their respective S&P Dow Jones Indices benchmarks. The results demonstrated that most active managers underperformed their respective benchmarks.

Percentage of U.S. Equity Funds Outperformed by S&P Benchmarks

Ten years ended December 31, 2014

Identifying Outperformers Beforehand

In selecting managers, many review past performance, believing managers with superior track records will produce superior returns in the future. The problem with relying on past performance is most managers do not have a long enough track record to distinguish whether their returns were the result of skill or luck. Statistical analysis often requires decades of performance data to determine whether a manager is truly skillful or unskillful. Furthermore, studies have demonstrated that performance is not persistent. Vanguard recently conducted a study analyzing the persistency of actively managed U.S. equity mutual funds and found no correlation between the past five year performance and the subsequent five year performance.

Patience

Investors who select active managers must be willing to be unusually patient to have any chance of long-term success. Most investors are unwilling to tolerate extended periods (3-5 years) of underperformance, often changing strategies at the most inopportune time (when their performance is at its worst). Statistical analysis shows that even the best managers will underperform in over 30% of 5-year periods.

Conclusion

Regardless of labels, by focusing on portfolio construction and disciplined rebalancing to diversify and mitigate risk, there is a higher probability that investors can attain their investment objectives, especially over the long-term. Investment theory, academic studies, and real world results demonstrate that active stock managers have difficulty outperforming their benchmarks. Therefore, we invest in index funds and other low cost strategies that consistently and efficiently capture desired market factors. Combining this approach with a dedicated team that understands each client’s complete financial picture is far from passive.

Click here to download additional insights from Chris Meyer on the drawbacks of active management.