Three Key Changes in Tax Law and How To Capitalize on Them

The Tax Cuts and Jobs Act (TCJA), in effect for 2018, has received so much attention that it may seem like old news. But, our tax team is still hard at work, helping our clients capitalize on this new landscape.

And one thing is clear: many Americans don’t fully understand the new law — or what they can do now to reduce their tax bill next April and over the long term.

We’ve identified three major tax changes that deserve a closer look, some go-to strategies for this new environment and questions to help start the conversation with your tax advisor.

1. Lower and wider tax brackets — but only for a few years

The new rate structure is one of the most significant changes. Now, most taxpayers will experience lower marginal and effective rates than they did previously.

The new 24% bracket is particularly wide. Many people who were previously in the 28% or 33% brackets may now be in this 24% bracket — enabling them to realize more income with fewer tax consequences. Current brackets sunset in 2025. If you have untapped income, this may be a good time to recognize it.

This year we’ve recommended that many of our clients convert investments in traditional IRAs to Roth IRAs. This strategy moves investments from a tax-deferred environment to one where investments grow tax free. The catch: conversions are treated as taxable income in the year they occur. Many taxpayers may be uncomfortable with paying taxes on IRA distributions before they must. But with lower rates, it’s now a very attractive option.

Explore further:

- Do you have a traditional IRA that you should convert to a Roth?

- Does your employer offer a Roth 401(k?)

- Is there income you should recognize while in a lower bracket?

2. A larger standard deduction

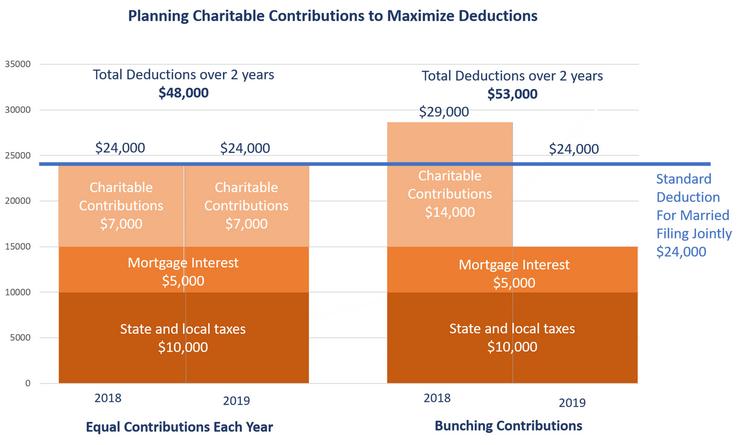

The standard deduction has essentially doubled — now $12,000 for a single taxpayer and $24,000 for a married couple filing jointly. Taxpayers must either itemize deductions or use the standard deduction. So, many people who previously had enough deductions to itemize will now take the standard deduction.

With a little planning, though, you can still benefit from itemizing. For example, you can “bunch” charitable deductions in alternating years—itemize deductions one year and take the standard deduction the next, maximizing deductions over time. Transferring appreciated assets to a community foundation or using a charitable checking account are great options for implementing this strategy.

If you are 70 ½ or older, consider a Qualified Charitable Distribution (QCD), which allows the donation of funds directly from an IRA to charity. These contributions can’t be included as itemized deductions, but you can exclude them from income.

Explore further:

- Should you “bunch” charitable donations and alternate between itemized and standard deductions?

- Does a charitable checking account fit your goals?

- Would a QCD be beneficial?

3. Additional deductions for business owners and the self-employed

There’s now a 20% deduction on qualified business income for owners of sole proprietorships, partnerships and S-corporations.

Under this new provision – 199A (named for the code section) — there are restrictions on which income qualifies for the deduction. If income exceeds certain thresholds, the deduction is reduced or even eliminated. This is especially true for specified service businesses. As such, managing income from year to year is important.

Consider matching higher charitable contributions or business expenses with higher income years. Additionally, maximize contributions to a self-employed 401(k) or defined benefit plan to increase the business income deduction and boost retirement savings.

The 199A deduction is not allowed against employee wages. So, if you’ve been thinking about starting your own business or becoming an independent contractor, the 199A deduction may be an incentive. If you’re evaluating this option, there are many factors to consider. If you’re thinking of changing roles from employee to independent contractor, be sure your facts and circumstances fit the IRS definition of contractor rather than employee.

- Should you open a self-employed 401(k) plan or implement a defined benefit plan ? Can you maximize contributions?

- What other income-reducing strategies should you consider?

- Does this new deduction make it the right time to start a company?

Be proactive. Talk with your tax advisor about changes you can make — today — that will benefit you on April 15. Discuss your specific situation — employment, investments, and charitable goals — to get comprehensive advice and minimize your taxes in the long-run.