2020 Market Review: Timeless Lessons from a Historic Year

In investing terms, 2020 was notable for a significant—but brief—market downturn, as well as a remarkably rapid rebound, all of which occurred against a backdrop of once-in-a-generation events. Rather than monitoring portfolios, people around the world focused on how to live productively and happily while confined mostly to their homes. As you reflect back on 2020, you might mostly recall the amount of time and energy you spent trying to procure food and supplies, set up a viable home office, stay connected to family members and friends despite physical distance, and assume the responsibilities of online school supervisor.

Unsurprisingly, you may not vividly remember that markets dropped by about 35% over just a few weeks. Many people were simply too overwhelmed by the larger issues to pay close attention, and ironically, by the time they realized the magnitude of the fall, returns had already begun to shift direction.

Still, asset flow data reveals that a significant number of investors sought out safety when the pandemic initially unfolded; there were record outflows from stock funds and record inflows to money market funds. It is understandable that investors craved calm and predictability amidst unprecedented uncertainty. March was uncharted territory for most of us. With hindsight over the whole year, however, we can detect a familiar lesson: markets have a way of rewarding those who have the patience—and the stomach—to persist during difficult times.

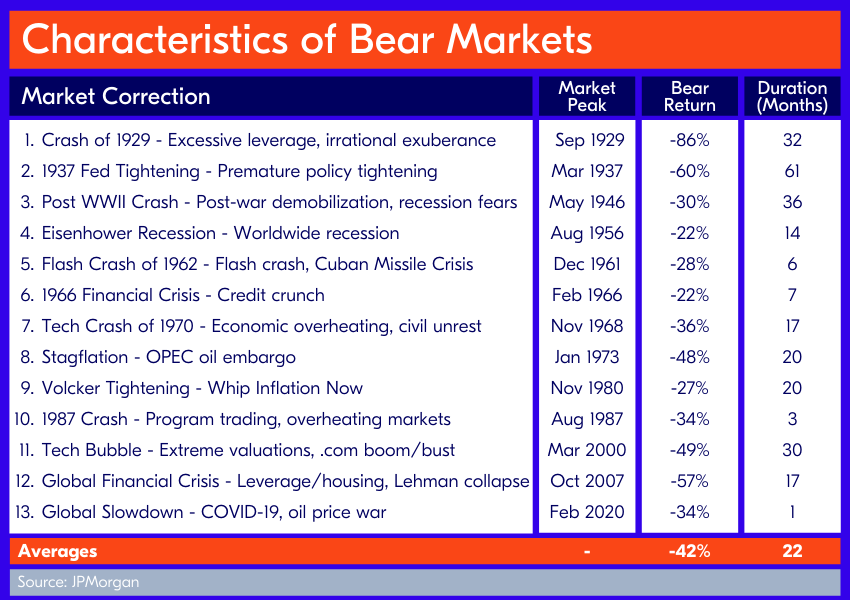

Historically, market returns typically bounce back before the broader economy does. This certainly held true in 2020. The March downturn was the shortest market drop in history, lasting less than one month, compared to the last record holder—a three-month decline in August 1987. And, on average, bear markets have lasted 22 months, as seen in the table below.

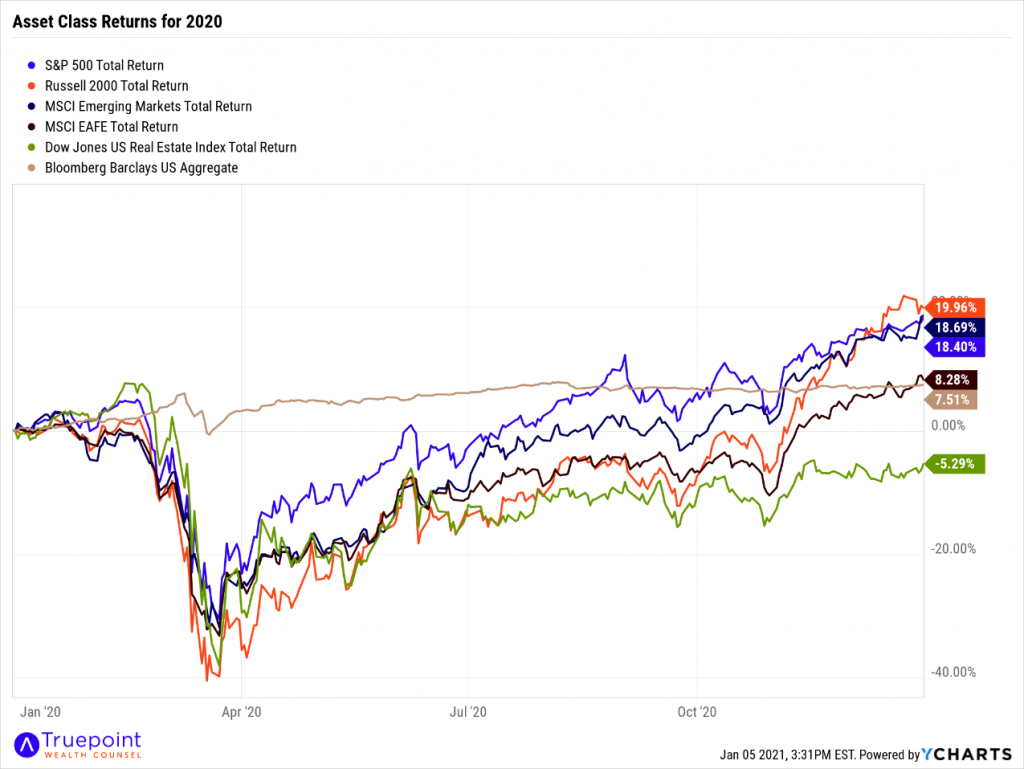

When turnarounds are this quick, it is almost impossible to withdraw assets while markets are falling and still participate in all of the subsequent upswing. And that upswing has been considerable. U.S. small-cap stocks endured the biggest fall at the start of the pandemic, but have since enjoyed the most impressive returns, generating almost 98% since March 23 and 20% for the year. International stocks have also recovered well from the downturn. Emerging market stocks just beat the return of the S&P 500 for the year. On the other hand, the broad U.S. bond market has generated remarkably steady returns since March, holding firm at around 7% for months. Notably, the real estate sector continues to struggle relatively. Since the bottom in March, it has returned just under 50%, not enough to make up for its over 40% drop at the beginning of the year.

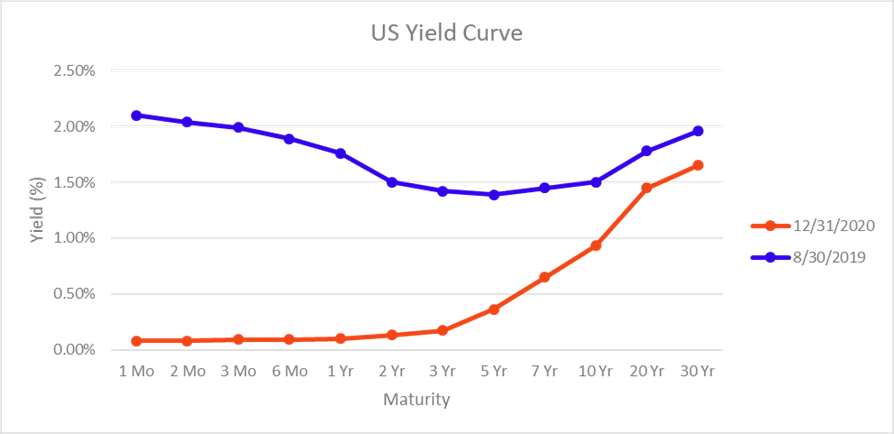

True, this year’s market’s ups and downs were historic, but it is worth noting that a downturn had been anticipated for some time. Although they may be a distant memory now, 2019 year-end commentaries were filled with warnings about a possible recession, as signaled by the inverted U.S. yield curve. The U.S. yield curve is a graphical representation of the yields of U.S. Treasury bills, notes, and bonds in order from shortest to longest maturity. The yield curve is described as inverted when short-term bonds offer a better yield than long term ones. Usually, longer-term bonds offer a better yield because investors expect to be well compensated for tying their money up for so long. In addition, higher long-term yields indicate optimism about the economy—an expectation that conditions will improve as time passes. But when long-term bond yields start to fall—and especially when they fall below short-term yields for a sustained period—it often indicates an impending downturn in the economy. As such, the curve between three-month and 10-year yields has inverted before each of the past seven U.S. recessions. Nevertheless, with the stimulus and support provided by the U.S. government and Federal Reserve, the yield curve has returned to a normal, upward-sloping curve, signaling the expectation that economic conditions will improve.

But what no one could have predicted—especially when the yield-curve first became worrisome in the summer of 2019—was that this downturn would be caused by a novel coronavirus and a resulting global pandemic. Instead of turning to economic indicators as harbingers, analysts looked to new signs, like transmission rates, shutdown announcements, and vaccination updates. This is a marked difference from the last—and so-called “great”—recession, which was triggered by the implosion of a group of incredibly complex and esoteric financial instruments that even the savviest investors did not fully understand. By comparison, the 2020 recession has been both more physical and more visible than the previous one. When planes are only half full, the travel industry suffers. When tables sit empty on Saturday nights, bars and restaurants close. And just as the precipitating causes of this crisis are more comprehensible, so are the positive signs that provide hope. Fiscal stimulus buoys market confidence; vaccine announcements stoke optimism.

In terms of the capital markets and investing, what the past 12 months have demonstrated is that even when the consensus correctly predicts a particular outcome—such as the end of a prolonged bull market—analysts can and will still be incorrect about incredibly important elements, including the causes, the precise timing, and the duration. In short, we don’t know what the surprises will be until we are surprised.

This does not mean, however, that such analysis is useless; rather, it is necessarily limited. Another story that dominated 2019 year-end commentaries was whether the valuations of U.S. stocks could be sustained. Since the great recession, U.S. stocks have dominated global market returns. Investors expected U.S. companies to grow faster than those in the rest of the world, and they did. Ten years on, though, and U.S. stocks have reached high valuations, specifically U.S. large cap stocks. Relatively, small cap value stocks still have a lower valuation, as seen in the table below. Even compared to emerging and developed international market’s valuations, U.S. small cap value is more attractive. Although we believe that equity valuations are meaningful, we should also note that the disparity between U.S. and international stocks and growth and value stocks has been in place for several years. We certainly cannot predict when conditions will shift and valuations will narrow. But, to return to our earlier lesson, markets have a way of rewarding those investors who are patient and willing to take on risk. Abandoning an entire area of the market, such as emerging market or small cap value stocks, because of short-term underperformance is rarely a lucrative long-term strategy.

In addition, the recent market recovery may not continue unabated. If there are difficulties with vaccine rollout and delivery, the market could change direction. Plus, much of the global economy is bolstered by fiscal stimulus and supportive monetary policies. Though this scaffolding is unlikely to be pulled away suddenly, it is worth keeping in mind the significant support provided by central banks.

This was a difficult year for many for multiple reasons, and we understand the impulse to seek safety by moving from stocks to bonds or cash during challenging times. But doing so only shifts your risk exposure from market risk to inflation and longevity risk (the risk that your return won’t keep pace with inflation, or that you may outlive your assets). For better results, you must take on market risk, but determining the “right” level of risk, or allocation to stocks, for you depends not only on your financial goals, but also on your comfort level with market movement and desire for security.

We want our clients to know that their portfolio has been built to withstand difficult times and that enduring market volatility is the cost of earning long-term market returns over their lifetimes. This year underscores why this is so important. Who would have predicted U.S. markets would rally given the historic circumstances in 2020? Those who remained invested through the initial downturn experienced the full extent of the upswing. Therein lies the power of strategic, long-term investing. You can endure significant—and even historic—downturns because your plan does not rely on any one day’s, week’s, month’s, or even a year’s worth of returns.