The Failure of Fortune Telling: It Won’t Make You a Fortune

In our year-end market commentaries, we like to look back a year to see how various predictions about market performance ended up playing out. And time and again, we discover that most of these predictions turn out to be not all that accurate.

It’s hard to believe that one year ago,we were talking about a volatile and depressing December 2018. Major U.S. indices dropped almost 9% during the month—with both the Dow and the S&P 500 recording their worst Decembers since 1931 and their biggest monthly losses since the global economic downturn. The S&P 500 hit its low point on Christmas Eve 2018, down more than 20% from its record high. But during the very next session, the market rallied, and the Dow gained more than 1,000 points on December 26, its largest single-day gain ever.

Given that wild ride, it was especially challenging to predict how the markets would perform in 2019. While most analysts admitted that the volatility of 2018 made projections difficult, consensus formed around the belief that markets would improve from their December 2018 lows, though not significantly. Many analysts estimated that the S&P 500 might hit 2,900 for the year, providing that overall economic news remained positive. Of particular concern to this outlook was the uncertainty surrounding the U.S.-China trade deal.

Fast forward a year, and the uncertainty around trade issues remains. Yet stock returns have significantly exceeded most analysts’ predictions regardless. At the end of the year, the S&P 500 traded above 3,230 and had delivered a calendar year return over 31%—an incredibly robust performance, especially in light of analysts’ lackluster predictions.

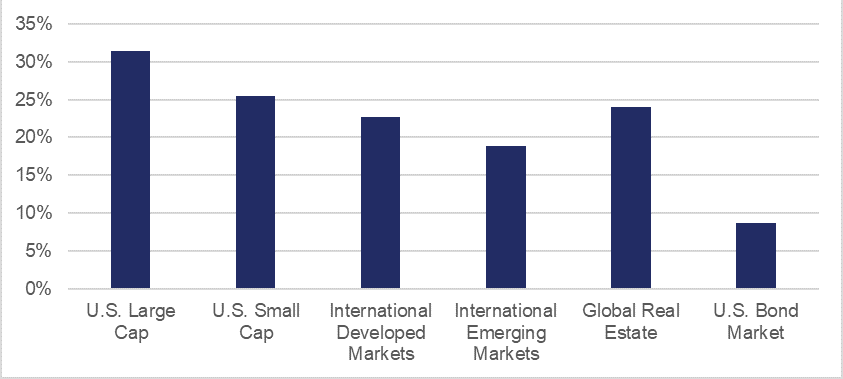

Across global markets, we saw similarly strong returns in 2019, as seen in the chart below.

2019: A Strong Year for All Asset Classes

These returns are hardly the uninspiring results that many analysts predicted as we limped out of 2018.

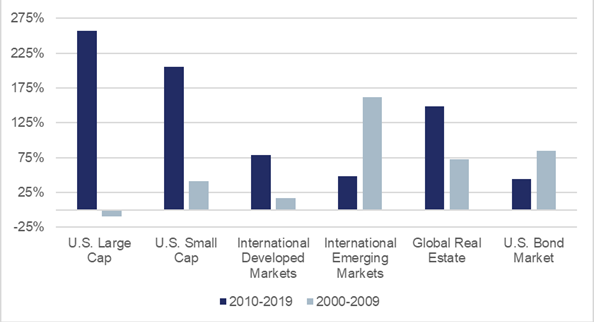

Even over a longer time frame, returns prove difficult to predict. When we look back at the past decade, we see strong returns across asset classes. Specifically, during the past year and the past decade, U.S. large cap stocks and global real estate have performed exceptionally well. It would be easy to conclude, given this data, that investors should just stick with big U.S. stocks and perhaps use real estate as a diversification tool. But when we look at returns from the previous decade, from 2000 to 2009, it becomes clear that this strategy would have proven very disappointing. The chart below shows cumulative returns across asset categories over these two time periods.

A Tale of Two Decades: Divergent Returns Over Time

Over the ten-year period from 2000-2009—which included the bursting of the tech bubble as well as the start of the global financial crisis—emerging market stocks soared, clobbering both the S&P 500 and U.S. real estate.

This decade from 2000-2009 is often referred to as the “lost decade.” It’s easy to see why. It was the only decade in which the S&P 500 produced a negative total return since the financial industry began tracking return data—back in 1926!

Those are sobering figures, but they don’t tell the whole story. As we’ve already pointed out, emerging market stocks did exceptionally well during this period. Additionally, mid-cap and small-cap U.S. stocks performed much better than S&P 500 stocks during this decade—returning more than 6% on an annualized basis. So, this wasn’t a “lost decade” for those investors who maintained diversified portfolios and kept a long-term view in mind.

All of this data underscores how difficult it is to predict which asset classes will outperform and over what time frame. Unsurprisingly, though, this hasn’t stopped various pundits and prognosticators from warning investors that we’re on the precipice of another “lost decade”—and they have been doing so for the past 10 years! Think of the returns you’d have missed if you had listened to these fortune tellers!

The bottom line for investors is that the best strategy is to build a diversified portfolio and invest for the long haul.

The Interest Rate Roller Coaster

Importantly, it’s not just market returns that have proven difficult to project. Interest rates have also stymied forecasters. In fact, the chairman of America’s largest bank has swung from predicting a sharp increase in interest rates to—in just over a year—asserting that they could plunge to zero!

All the way through December 2018, JP Morgan anticipated that interest rates would increase, though ultimately rates were cut three times in 2019!

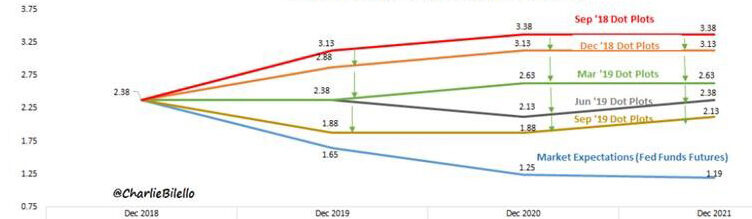

Financial professionals aren’t alone in their difficulties projecting rates. The Fed itself has been surprised! Each quarter after it meets, the Fed releases projections of future interest rates, and even it has recently had trouble anticipating its upcoming decisions. The dot plot, pictured below, illustrates the Fed’s expectation of the Fed funds rate at various times in the future. An upward trajectory signifies a “tightening” cycle of rising rates, while a downward slope indicates an “easing” cycle of declining rates.

In the chart below, the red line represents the Fed’s expectations as of September 2018. At that time, it was projecting that the rate would hit 3.13% by the end of 2019. Fast forward to December 2018 (orange line), and the Fed’s expectation had fallen to 2.88%. By March (green line), the prediction was down to 2.38%. In just six months, the Fed’s outlook for their own interest rate had fallen 24%.

The Fed Keeps Shifting Its Own Projections, Too

The graphic below shows how widely these various projections can vary and change over time. Every quarter between September 2018 and now, the Fed has lowered its expectations for future interest rates. However, it does not anticipate a precipitous drop in rates over the longer term; it has lowered its projection of the rate but predicted a steady rate environment over time.

Fed Dot Plots (Median) vs. Fed Funds Futures

What Does All of This Conjecture Mean for “Normal” Investors

One takeaway from all of these projections: no one can predict with certainty what future interest rates will be. Absent luck, correctly forecasting future interest rates would require accurate prediction of:

- Countless economic data points

- The collective sentiment of millions of market participants

Another takeaway: the headlines surrounding monetary policy greatly overemphasize its relevance to most Americans. Keep in mind that the Fed only controls one rate – the rate at which banks lend each other money overnight. That rate has only a loose relationship with other interest rates, such as government bonds and mortgages, and it has no discernable effect on arguably the most important rates for average Americans: what they’re paying on credit card debt and receiving on cash in their savings accounts.

Moving a chunk of cash to a higher-yielding savings account or paying down credit card debt is a much better use of most people’s time than losing sleep over Fed policy.

The same holds true for your investment decisions. The Fed’s actions on interest rates should not spur you into action. Yes, the markets may react to news of an unexpected lowering—or to a shift in consensus expectations. But data show that these market reactions also level out over time—and often very quickly. These blips should not deter you from a time-tested strategy.

Just as short-term financial news is largely irrelevant to your investing strategy, so is political news—even major headline events like impeachment. Cable news may be dominated by these stories, but their effects on the markets—and especially on long-term performance—are negligible. In fact, despite warnings to the contrary, in the days following the House impeachment vote, U.S. markets remained steady. Shifting your strategy in anticipation of such events, which are out of your control, has been shown to be a losing strategy.

This time of year is filled with resolutions for the new year. But if you work in the financial industry, it’s also filled with some awkward discussions about people’s favorite investment “hunches.” Perhaps it’s about Amazon—how it’s overvalued, undervalued, a monopoly about to explode, or an innovative company that will remain at the forefront. Or it could be your cousin bragging about how he smartly foretold the WeWork IPO fiasco. Or it could be your neighbor confessing about investing heavily in a trendy company, and it not quite panning out. Especially when market returns are robust, people become eager to participate in every hot idea. Yet such impulses consistently generate poor results, and the data shows that investors do not have the fortune-telling capabilities they imagine.

Truepoint clients understand that the only way to win this kind of game is not to play. They understand that investing is not a race in which there are only winners or losers. Instead, they see their portfolios as a means to help them achieve their unique goals and dreams. As 2019 and the decade came to a close, we encourage you to take a victory lap for avoiding the pitfalls of trends and predictions. We are grateful to work with clients like you, who can stay above the noise and focus on more meaningful and material issues.