Muni Madness

On July 18th, the city of Detroit became the largest municipality to file for Chapter 9 bankruptcy, seeking to restructure roughly $18 billion in debt. While many media outlets have attempted to create a shock factor, the insolvency did not come as a surprise, as the financial struggles facing Detroit have been well-documented for decades.

For investors, one of the concerns regarding Detroit’s Chapter 9 filing may be the potential impact it has on the market for municipal bonds. A municipal bond is a debt obligation issued by governmental entities which, in turn, use the money for public projects. Municipal bonds may be general obligations of the issuer or secured by specified revenues. In return, the municipality promises to pay the investor a specified amount of interest and returns the principal on a specific maturity date.

Investors concerned about the impact of a bankruptcy filing in Detroit, or any other municipality, must keep in mind that each municipality has its own unique budgetary risks and limitations, independent of the risks facing other municipalities. Although historic in size, the troubles facing Detroit are not contagious. For example, Detroit’s inability to pay its debts accordingly has no direct impact on the ability of Cincinnati, or any other city or town, to meet its own unique obligations. Even with this in mind, the media often attempt to report on the municipal bond market as if it were a single, uniform segment. However, there are many factors to consider when developing expectations for the municipal bond market.

The municipal bond market is large and diverse. The market comprises over $3.7 trillion in debt, with about 55,000 state and local issuers and approximately 2 million outstanding issues. Municipal bonds are rated across a broad spectrum of creditworthiness and have different characteristics and structures for paying their obligations. Such complexity does not afford simple observations about the market. Furthermore, while Detroit is the largest municipality to file for bankruptcy protection, its debt represents a mere 0.05% of the entire municipal bond market. Thus, the potential impact from any individual municipality default is minimal.

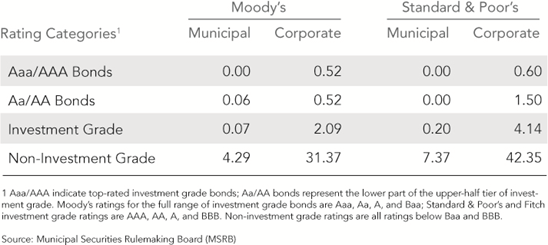

Historical default rates are low. As the chart below shows, municipal bonds have a strong track record of repayment. One reason is that state and local governments are motivated to avoid default since their failure to pay affects their ability to raise capital in the future. “How Rare Are Municipal Bankruptcies?”, an article that ran in the January 24, 2013 issue of Governing magazine, reported that it is overall extremely rare for municipalities to declare bankruptcy, with only 13 cities or towns (about 0.06%) doing so since 2008.

Percentage of Bonds Defaulting: 1970-2008

Not only are the default rates much lower for municipal bonds than corporate bonds, but the average recovery rate (the fraction of the original principal and accrued interest which is ultimately paid to the creditor on a defaulted debt) for U.S. municipal bonds is also higher than those on senior unsecured bonds of corporate issuers. “U.S. Municipal Bond Defaults and Recoveries, 1970-2011,” a study published by Moody’s in 2012, states that “the average recovery rate for municipal bonds was 65% for the period 1970-2011, compared to 49% on corporate senior unsecured bonds over 1987-2010.” In other words, municipalities in default have paid off a greater portion of debts to creditors than corporations in a similar situation.

Municipal bonds are relatively transparent. Ever since Wall Street analyst Meredith Whitney predicted massive municipal bond defaults in an interview with 60 Minutes in 2010, analysts and retail investors alike have been quick to search for similarities between the municipal bond market and the subprime mortgage securities market prior to the financial crisis. However, municipal bonds are not exotic instruments with complex structures that obscure underlying credit rating and value of the assets. As a result, municipal bonds are generally more transparent than the mortgage derivatives that helped spark the financial crisis. This transparency allows market participants to more quickly and accurately react to changing market conditions and discover appropriate market prices based upon available information at any given time.

Municipal Bond Risk-Management

The same basic risk-management techniques used for taxable bonds hold true for municipal bond investing, as well.

Hold shorter-term issues. Fixed income investors must consider their exposure to interest rate risk. Shorter-term issues exhibit greater price stability over time because they are less vulnerable to price changes caused by interest rate fluctuations. By holding shorter-term issues, investors can protect their fixed income portfolio from experiencing dramatic price declines during periods of rising interest rates.

Stay broadly diversified. Holding many municipal bond issues and avoiding concentration in a particular state, sector, or issue type can help reduce the impact of a few non-performing bonds. If default rates unexpectedly rise, investors with a well-diversified municipal portfolio should be less exposed to the defaulting issues.

Focus on quality and use market pricing to confirm credit ratings. The most creditworthy bonds are those rated AAA or AA, and most of the current problems involve lower-rated bonds. Although ratings are useful, recent history in the mortgage-backed securities market has shown that a bond may not be rated accurately. A bond that is rated AAA should trade in a similar price range to other bonds with similar characteristics and a comparable rating.

The Detroit bankruptcy is indeed historic and has caused many investors to re-think their municipal bond portfolios in fear of a systemic municipal default crisis. However, the impacts of this historic event appear isolated and are unlikely to cause major ripple effects across municipalities. As with any investment strategy, a diversified approach reigns supreme when investing in municipal bonds.