Instilling Financial Literacy in Children

How many times have you heard this from your kids: “All of my friends have iPhones, why can’t I have one too?” Or perhaps your teen “needs” a new car because the old hand-me-down from dad is just too embarrassing. It’s rare a parent hasn’t heard their children complain about not having what they want, but how many know what it takes to earn the money that pays for it? A quick review of some statistics highlights the fact that we need to do a better job of instilling financial literacy in children:

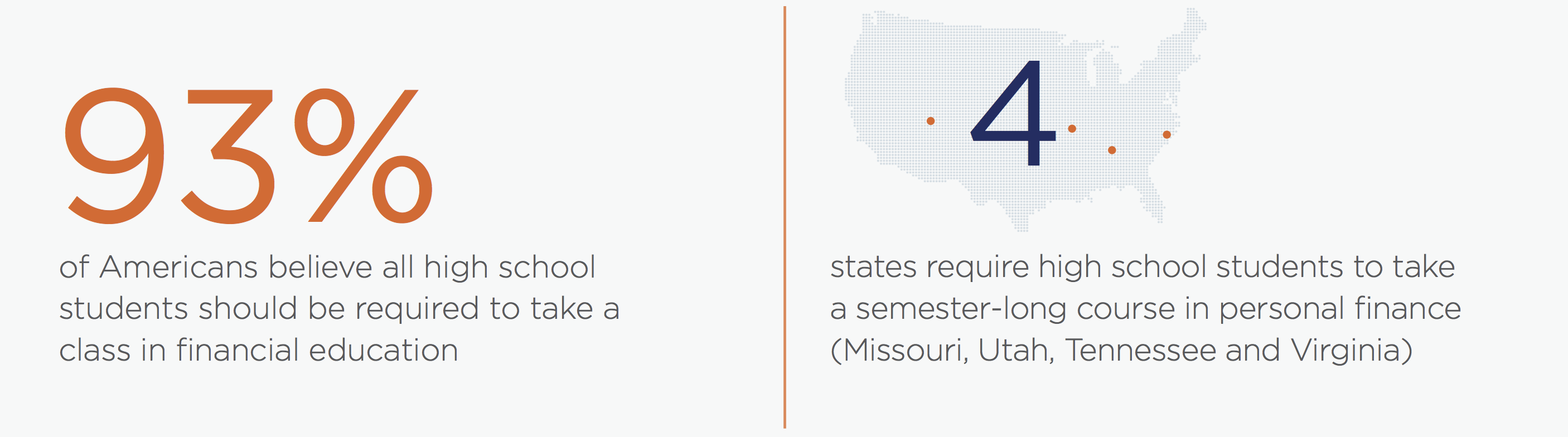

- 93% of Americans believe all high school students should be required to take a class in financial education however, to date, only four states (Missouri, Utah, Tennessee, and Virginia) require high school students to take a semester-long course in personal finance.i

- More than half of U.S. adults, or 56%, admit they do not have a budget.ii

- One-third of U.S. adults, or more than 77 million Americans, don’t pay all of their bills on time.iii

- 57% of adults indicated they worry about a lack of savings. Of this group, 43% are concerned about not having enough “rainy day” savings for an emergency and 38% are concerned about retiring without enough money set aside.iv

It’s never too early to start teaching financial literacy to children

As soon as children can count, introduce them to money. Start giving them an allowance and set up three jars – one for saving, one for spending and one for giving. Parcel the money out in small denominations and encourage the child to make contributions to each. Talk about the importance of each category and try to give an example of how it might be used – saving for a special purchase, spending on everyday items like stickers, or helping the less fortunate. Make it relevant by relating to things happening in their world.

Teachable moments:

- Let children pay for their items at the register and experience the process of exchanging money for goods or services.

- Expose children to your charitable giving by volunteering together at a soup kitchen, doing yard work for an elderly neighbor, or donating clothing.

Educate kids on the basics banking

When you believe they are ready, introduce children to banking. Teachable moments abound, particularly if parents are willing to set limits. For example, if your son wants a bike that costs more than you are willing to pay, have him contribute the difference from his savings. This will give him the experience of deciding if the purchase is worth it.

Teachable moments:

- Introduce the concept of “wants” versus “needs.” For example, “You say you want a guitar but are you willing to share in the cost?”

- Go to a bank and set up a savings account. Have your child make the deposit and learn how to access the account online.

- Create a spreadsheet in which your child can track deposits, interest, withdrawals, etc. in order to keep track of “savings” and where the money is going. Set aside time to review it together, so you can talk about the process of banking and explain the fundamentals, such as budgeting, as well as more complex topics, like compound interest.

Let young people learn to earn

An important step in financial literacy for children is learning to earn money. Even before they can legally work, encourage your children to earn money. Remember that bike that your son wants? If he hasn’t saved enough to assist in the purchase of the bike, help him set a goal toward earning that money. Suggest walking the neighbor’s dog, babysitting or even washing cars to help obtain the additional funds. Take it a step further and teach him to calculate how many cars he would have to wash, earning $10 per job, to reach his goal. By understanding the relationship between work and money, your children will develop financial literacy and life skills such as responsibility, independence, and discipline.

Teachable moments:

- Let children set a goal and find the work. Setting goals is fundamental to learning the value of money and saving.

- Try to instill a “pay yourself first” mentality to encourage putting something into savings each time children get paid.

- When the time comes to make a purchase, have your children researched and found the best price? Help them look online to compare prices, search for promotions, etc.

Taming the acquisitive teen

As children move into their teens, you can start introducing them to actual money management. Having teenagers assume responsibility for a checking account, debit and credit card in high school allows them to master the financial skills they will need when they go away to college. While they can set up online banking, it is still a good idea to have them track all account activity in a register and balance with their monthly statements. The debit card is the first step toward working with credit, as the purchase will not be authorized if there are insufficient funds in the account. When you introduce the credit card (initially you may have to co-sign), emphasize the importance of paying the balances in full each month and the implications of not doing so (interest charges, late fees, and impact on credit scores).

You may also consider setting up a small investment account and teaching the fundamentals of investing (short vs. long term goals, risk vs. reward, asset classes, etc.). This is an advanced way of teaching financial literacy for children and provides teenagers the opportunity to apply that knowledge toward investing in actual financial markets and tracking the investments.

Teachable moments:

- Work with your teenager to create a budget for back-to-school clothing and pay using a credit card. Then, teach him or her to keep track of the receipts, reconcile with the billing statement, and make the payments from their checking account.

- Lend your teenager the down payment for a car. Work out a repayment plan together including interest, principal, and schedule of payments.

- Give teenagers the opportunity to overcome challenges. Denying them the struggles that are a natural part of learning may handicap their growth. Better to have these happen under your tutelage so they are equipped to deal with them later in the real world.

If one teaching strategy does not work, try to find another way to convey a concept, as children learn in different ways. Lead by example, be engaged, and be consistent. Remember, in doing so, you are helping to promote a healthy mindset around financial literacy for children which will afford them the opportunity to make smarter decisions throughout their lives.

Start a conversation with us about your finances or check out these helpful financial literacy websites that provide guidance for parents, as well as resources and games for children of all ages:

www.themint.org

www.practicalmoneyskills.com

www.feedthepig.com

www.familyeducation.com

iSource: 2012 Visa survey

iiSource: 2012 Financial Literacy Survey of adults, conducted on behalf of the National Foundation for Credit Counseling, Inc.

iiiSource: 2012 Financial Literacy Survey of adults

ivSource: 2012 Financial Literacy Survey of adults