A Path Through Uncertainty

“Those who have knowledge, don’t predict. Those who predict, don’t have knowledge. ”

—Lao Tzu

Volatility remains the keyword in the markets, at least in part because of the uncertainty surrounding trade policies and tariffs. Despite these concerns, the underlying U.S. economy appears strong, as second quarter earnings growth estimates for the S&P 500 hit about 19% for the quarter—the highest quarterly growth rate in over seven years.

With all this underlying growth, it came as little surprise in June when the Federal Reserve increased a key interest rate, affecting rates on credit cards, home equity lines, and other kinds of borrowing. This was the second increase of the year, following an earlier increase in March, and it marked the seventh increase since 2015.

Also, during the June meeting, Fed Chairman Jerome Powell and his colleagues indicated that they expect two more rate hikes this year, citing historically low unemployment levels; this is an increase from the previously anticipated three hikes for 2018. A low jobless rate threatens to stoke inflation, as competition for workers could spike wages too quickly, and the Fed is aiming to keep inflation at or below 2 percent.

Planning for the Unpredictable

In last quarter’s commentary, we explained how a rising interest rate environment can benefit the real estate sector, and we’ve been gratified over the past few months as our real estate holdings have enjoyed a significant rally. Though we can never predict the precise moment when a particular holding will rise or fall, we have built our investment process to identify and capitalize on shifts in the market.

The recent example of the U.S. real estate market is a helpful illustration of this phenomenon. By the end of 2017, U.S. real estate funds were struggling. Share prices had fallen, so real estate’s weighting in the portfolio had naturally lessened. By mid-January 2018, real estate prices had dropped so much that client portfolios drifted away from their asset allocation targets, leading us to buy U.S. real estate shares to bring portfolios back to their target weights. (We monitor each client portfolio every day for exactly these kinds of rebalancing opportunities.)

At the time, we could not have said when real estate would reverse course, and we certainly couldn’t have predicted that the rally would occur in just a few short months! Instead, rather than trying to predict the unpredictable, we use an objective and disciplined process in adjusting client portfolios. We are not investing on a hunch; we’re rebalancing portfolios to keep them in line with their long-term targets.

A disciplined approach to rebalancing is nothing new at Truepoint. It is a fundamental, consistent, and long-practiced hallmark of our investment process.

What is unique is just how fast the U.S. real estate market has rebounded. Our holding hit its low on February 8, 2018 at around $72, and in just a few months, it has come back to around $81 (a 12% increase from the February low). Such rapid turnarounds powerfully illustrate the importance of rebalancing.

Rebalancing Portfolios Through Economic Cycles

After 10 years of a bull market and ever-increasing market levels, we expect similar rebalancing opportunities across other components of our portfolios, including the balance between U.S. and international equities; between growth and value stocks; and between small-cap and large-cap holdings.

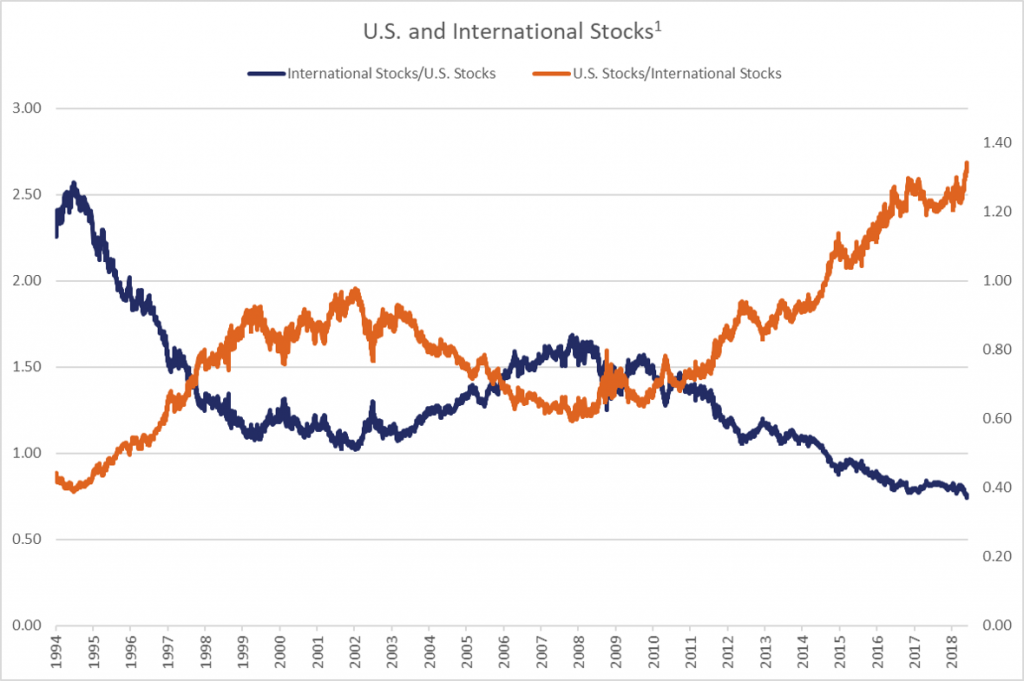

The following graph illustrates the difference in relative performance between U.S. and international stocks, showing a regularly occurring rotation between the two. For the past decade, U.S. stocks have outperformed international stocks. When we examine long-term returns, though, we can see that the trend is likely to reverse in the future.

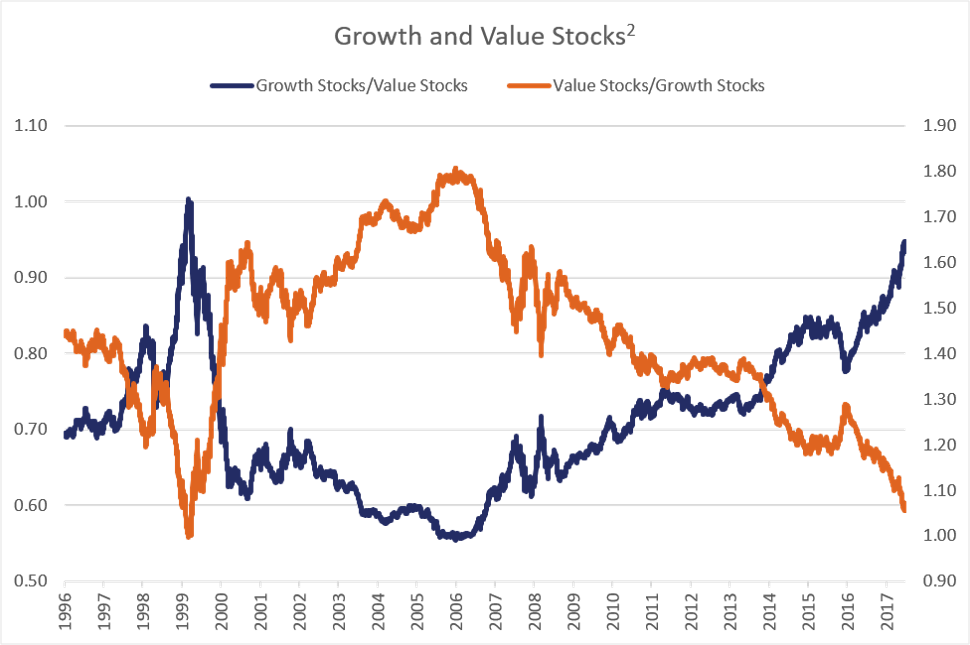

The gap between growth and value stocks is not as pronounced as U.S. versus international stocks, but it shows similar patterns. Throughout the late 1990s, in the first wave of the “dot-com” boom, growth stocks solidly outperformed value. As the business cycle shifted, value stocks then held relatively strong from 2000 to 2007. Over the past 10 years, though, growth has dominated again, with technology stocks once more leading the way.

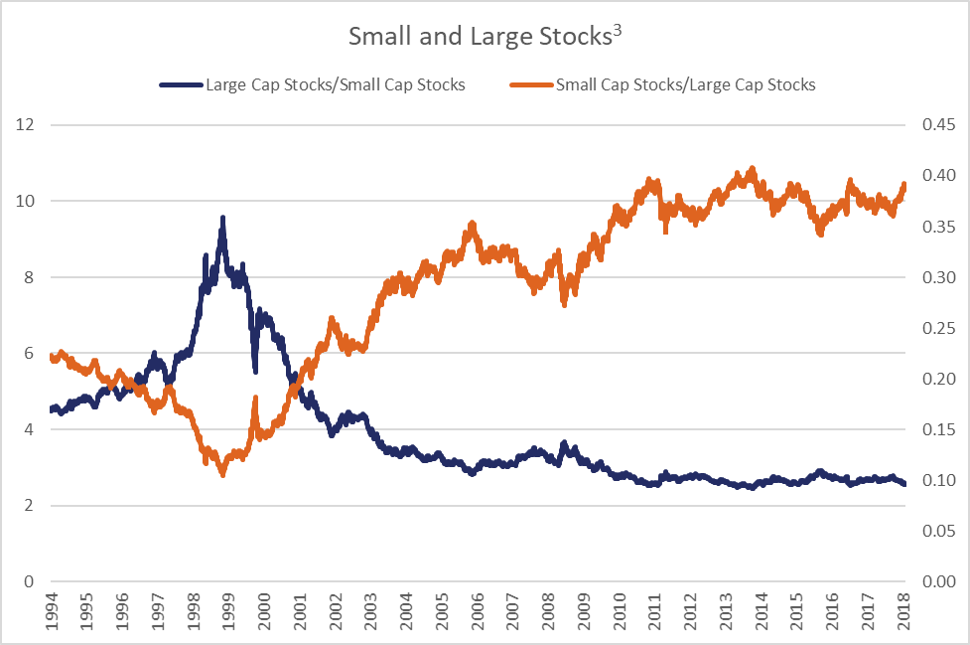

Finally, the difference between large and small cap capitalization stocks also seems poised for a shift. Since the global recession, small caps have outperformed large cap holdings. Yet again, the sizable gap in valuations indicates the trend is likely to shift.

Given strong corporate earnings and the historically high valuations of U.S. equities, many investors’ portfolios have likely drifted away from their targets, and some may have become quite imbalanced. It is important to remain vigilant about long-term asset allocation, especially when economic cycles shift.

In theory, portfolio rebalancing is rather straightforward—and even a little boring! But studies show, time and again, that it is quite difficult in practice. When share prices fall, it can be tempting to take a “wait and see” approach, hoping to seize upon the exact right time for a trade. Waiting on the sidelines over the past few months would likely have meant completely missing the rebound in U.S. real estate. Even worse, some investors sell when share prices are falling and don’t buy again until a rally is already underway, following emotions rather than long-term plans.

At Truepoint, we don’t run from an asset class, and we don’t blindly follow momentum. Our rebalancing process is one strategy that we use to craft a disciplined, repeatable approach to buying low and selling high.