It’s All About Perspective: Understanding Change in the Markets

“Change is the only constant in life.”

A few weeks ago, I was on a call with a long-time client who reminded me of this adage. To him—and to many other investors—markets seem to be changing faster than ever. It might help to remember Hyman Minsky, a famed economist, and his “financial-instability hypothesis,” which suggested that the financial system swings between robustness and fragility and that these swings are an integral part of the business cycle. Stocks are risky, in part, because of their cyclical nature: as stocks (or a subset of stocks) become more attractive, more investors buy them, and prices go up. Then, as these stocks become too expensive, they inevitably crash. Once they’ve fallen enough, investors start buying them again because their prices are attractive once more. This same basic cycle repeats across various asset classes, for different lengths of time, and at different speeds. But it continues nonetheless—and it is one of the key underpinnings of Truepoint’s investment philosophy.

The challenge of investing, of course, is that no one knows exactly where we are in this cycle, and no one can tell exactly when we’ve hit the valuation peak—or the bottom of a crash. And yet, many “experts” still claim that they can predict the precise moment when investors should start buying and selling particular stocks. Given today’s tumultuous times—with monetary policy shifts, political upheaval, and pricing disparities—it’s no surprise that many investors, like our clients, are concerned about the amount of change taking place. We wanted to take this opportunity to review some of the significant changes in the market today and provide larger perspective to guide investors through this uncertainty.

Monetary policy reverses

Following almost four years of tightening, or raising rates, the Fed changed directions with a rate cut in July 2019. On September 18, the Fed cut rates further by 25 basis points to a range of 1.75% to 2.00%. Following the meeting, Fed chair Jerome Powell noted that, despite the strong U.S. economy and low unemployment, potential risks were threatening the positive outlook. If the U.S. economy weakens, he said, a “more extensive sequence” of rate cuts could be appropriate. “Our eyes are open, we’re watching the situation,” Powell said, explaining that the Fed would stop cutting rates to sustain the expansion only “when we think we’ve done enough.” Given this shift in Fed policy, efforts to spur economic growth will carry the cost of a lower expected return from the bond portfolio, at least in the short term. Even still, bonds continue to serve as the ballast to the overall portfolio—offering stability when the markets go haywire.

A change in Washington?

As our country is only in the first innings of the impeachment inquiry launched by House Democrats, there remain more questions than answers to the investigation. But with that as our backdrop—and the next presidential election a little more than a year away—we’d be remiss if we didn’t advise our clients today to file their political emotions away someplace safe, someplace where they can do their investment portfolio no harm.

Despite the complex mechanisms of the U.S. economy and global markets, many still believe that the president’s actions regularly and substantively affect securities’ prices. This is more than a simplification; it’s a fantasy. Although political events can influence the market’s movements, especially over shorter time periods, long-term returns have very little do with the person occupying the White House. Historical data shows that investors would do well to separate their political beliefs from their financial planning. As Warren Buffett warned in 2017, “If you mix your politics with your investment decisions, you’re making a big mistake.”

Focusing on material market events

At Truepoint, we accept that change—be it political, economic, or some other force altogether—is a constant. But rather than acting out of fear or out of a belief that we can predict the future, we focus on meaningful market events and look for opportunities to exploit pricing disparities as they emerge.

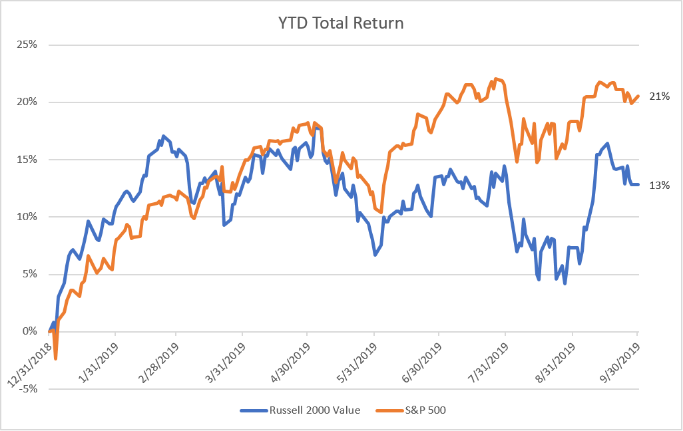

One example of the kind of disparity we focus on is the relatively weak performance of small-cap value stocks this year, compared to the broader markets. As evidenced in the chart below, the Russell 2000 Value Index, which tracks the performance of small-cap value stocks, has performed very differently in 2019 than has the S&P 500 Index, its large-cap stock counterpart. At multiple points throughout the year, the performance of these two indices differed by more than ten percent. Yet, more recently, small-cap value stocks have staged a significant rally and closed the year-to-date performance gap.

It is these kinds of changes in the market—the significant underperformance of a particular asset class—that catches our attention at Truepoint. When a wide disparity between market segments emerges, we rebalance client portfolios toward the underperforming asset class. This is because when an asset class underperforms for a sustained period of time, it automatically becomes a smaller percentage of an overall portfolio. Therefore, we employ dynamic rebalancing so that client portfolios remain aligned with their target allocations.

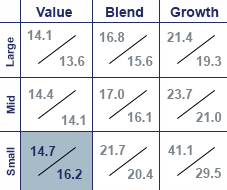

Regardless of the changes in the market that are constantly occurring, the guidance to “buy low, sell high” still holds true. And, recently, small-cap value stocks have given investors an opportunity to buy low. The graphic below shows how inexpensive small-cap value stocks are relative to their history. Specifically, their prices relative to expected earnings are low relative to the 20-year historical average.

While small-cap value stocks were featured in this commentary, the same valuation story and dynamic holds true for emerging market stocks this year as well—just as it has applied to different asset classes throughout the history of investing. This serves as a good reminder that diversification involves more than just splitting a portfolio between stocks and bonds or between U.S. and international stocks. It involves more subtle factors, such as large versus small companies and growth versus value. Some asset managers advocate strongly for one style or asset class over another, and so they may concentrate all of their portfolios, for example, in deeply discounted value stocks. In the long term, they might perform well, but over shorter time periods, they may experience extreme underperformance. This year, many “pure value” managers are significantly trailing their more balanced peers. If you’re an investor nearing retirement, a portfolio heavily weighted toward value could cause you significant distress.

That’s why our response to a changes in the market is not to tell our clients to sell all their large-cap domestic stocks in order to buy as many small-cap value names as they can. Rather, because we accept that “change is the only constant,” we remain prepared to take advantage of opportunities as they present themselves. We do this through relatively small reallocations, rather than wholesale bets. We are not trying to sell our clients on a particular product or a complete portfolio overhaul under the pretense that we can see the future. Instead, as always, we strive to adhere to a long-term, disciplined investment strategy—one that historical data supports. As we know, every asset class has its moment at the top, middle, and bottom of returns, so we strive to create balanced portfolios that can tactically and quickly adapt to disparities and opportunities.

Embracing change to identify opportunities

Because we recognize the importance of change, we continually monitor the market and our clients’ portfolios in order to identify investment opportunities. Capitalizing on changes in the market does not require making large bets, based only on predictions or hunches. Instead, at Truepoint, we use historical data and dynamic rebalancing to help us achieve our goals with steadiness and prudence. We recognize that our clients aren’t seeking to “get rich quick,” but they’d also prefer not to wait 20 years for a bet on one asset class to earn a significant return on their capital. They seek a balanced approach that will protect and grow their capital over the long term.