Whichever Way the Winds Blow: Understanding Tariffs and Trade Wars

Throughout the past quarter, global markets were strongly affected by the news of tariffs and a possible trade war. On any given day, such news sent markets reeling—or soaring—with seemingly little warning.

For example, on May 6, global stock markets plummeted following President Donald Trump’s declaration that the U.S. would impose fresh tariffs of 25% on $200 billion of Chinese goods and services. Then, just as quickly, on May 9, equity markets reversed their downward trend and moved higher on expectations that Trump might have eased up and opened the door to potential negotiations.

In such an environment, it becomes easy to believe that all the noise surrounding trade is meaningful. The tumult in the political sphere often gets mirrored by the markets in the form of volatile returns. We might be tempted to make investment decisions based on which way we think the trade wars will go, or we might decide to sit out altogether until some calm and order is restored.

At Truepoint, we believe neither prognostication nor panic is an appropriate response, so for this quarter’s commentary, we wanted to take a step back from the tweets and the headlines to take a more in-depth look at tariffs and trade. We’ll examine how tariffs work, explain why investors and global markets react to trade news, and detail how we approach news of trade wars in our own investment philosophy.

What Is a Tariff, and Which Ones Are We Talking About?

A tariff is simply a tax or duty on an imported good or service. Tariffs have been around for hundreds of years, and the U.S. has been placing tariffs on imported goods since its founding. Though tariffs are nothing new, they have become more complex as the global economy has become more integrated.

Today, tariffs are imposed for many different reasons—to subsidize certain industries, to preserve particular kinds of jobs for a nation’s citizens, or to protect national security interests. For example, the U.S. has frequently imposed tariffs on imported steel and aluminum in order to make U.S.-produced steel and aluminum products more attractive to businesses and consumers. In theory, these tariffs encourage U.S. businesses to remain in these raw material industries, which means the country will have its own supply of raw materials during times of war or international tension. Such tariffs also protect the jobs of U.S. workers employed in these industries. Similarly, the Chinese sell steel for less than what it costs to produce, and many analysts assert this strategy is intended to protect and create jobs for Chinese workers.

Because global trade is important to the U.S. economy, tariffs and other embargoes will occasionally dominate the headlines, but the fast-paced and more improvisational style of the Trump administration has kept a spotlight on the issue over the past few years.

After being the hot topic of 2018, trade disputes seemed to stabilize in early 2019, as the U.S. and China moved closer to a trade deal and Mexico and Canada signed a new agreement. This progress, however, was derailed on May 5, when the U.S. announced it would increase the current tariff on $200 billion of Chinese imports from 10% to 25%. China retaliated by imposing up to 25% tariffs on $60 billion of U.S. goods. Both increases took effect June 1.

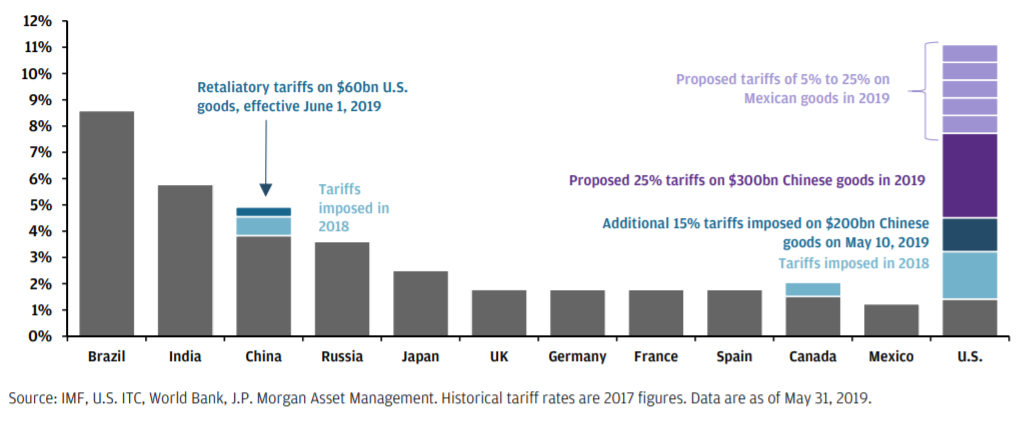

As can be seen in Exhibit 1, this has increased the U.S. tariff rate closer to China’s rates. For the time being, the U.S. has delayed imposing 25% tariffs on the remaining $300 billion of Chinese imports. In exchange, President Xi Jinping has pledged to make unspecified new purchases of U.S. farm products.

Economic disputes between the U.S. and China have now extended beyond trade. On May 15, President Trump signed an executive order that effectively blacklisted Huawei, preventing American companies from doing business with the Chinese tech giant. China retaliated by threatening to stop sending rare earths to the U.S. At the time of this writing, the original restriction on Huawei has been relaxed, but the details on any concessions are murky.

Why Do Tariffs Affect the Stock Market?

Generally, consumers benefit from global trade because it allows different nations and regions to capitalize on their unique resources. Instead of each country trying to produce all of the consumer goods that their citizens want, countries can specialize in producing the goods and services that are native to their part of the world. Countries can then trade with each other to acquire consumer items that they do not produce at home. This is helpful because few countries have the capacity to produce all of the goods their citizens desire. Specialization also can help lower costs for consumers. If, for example, a country can produce rice at a much lower cost than wheat, it can dedicate all of its resources to producing rice and then trade rice for wheat.

Because trade disputes can drive up consumer prices, erode company profits, and create instability for strategic planning and economic forecasting, investors typically react swiftly and dramatically to warnings of impending trade disputes.

Since 2017, the countries hardest hit by tariffs have been big export economies like Japan, Europe, and China, and manufacturing activity in each of these areas weakened significantly during 2018. And while the U.S. economy has demonstrated some signs of immunity, investors allocating only to the U.S. should heed caution. A tariff dispute that broadens and/or escalates could begin to negatively impact U.S. economic indicators and the economic uncertainty circling around these issues can be plenty harmful on its own.

The Rise of U.S. Tariff Rates (Exhibit 1)

At the moment, this year’s tariff increases are small and may lift U.S. consumer goods’ prices by only 0.2% this year, a manageable drag on consumer spending. However, if the additional tariffs on Chinese imports were eventually implemented, the impact of a 7.7% U.S. tariff rate on U.S. consumers would be far more meaningful.

In addition, the confusion generated even by potential tariffs and so-called “blacklisting” of international businesses can be quite harmful. With limited visibility on the future rules of the game, business confidence and corporate investment spending could spiral. Lastly, tariffs generate uncertainty around future economic and earnings growth, which can depress investor confidence and lower stock prices.

On the other hand, there’s still a chance that the U.S. and China will strike a deal in the coming weeks, or any time really. If and when this occurs, investors will likely respond sharply, and global markets could enjoy a significant rally.

The Trade Puzzle

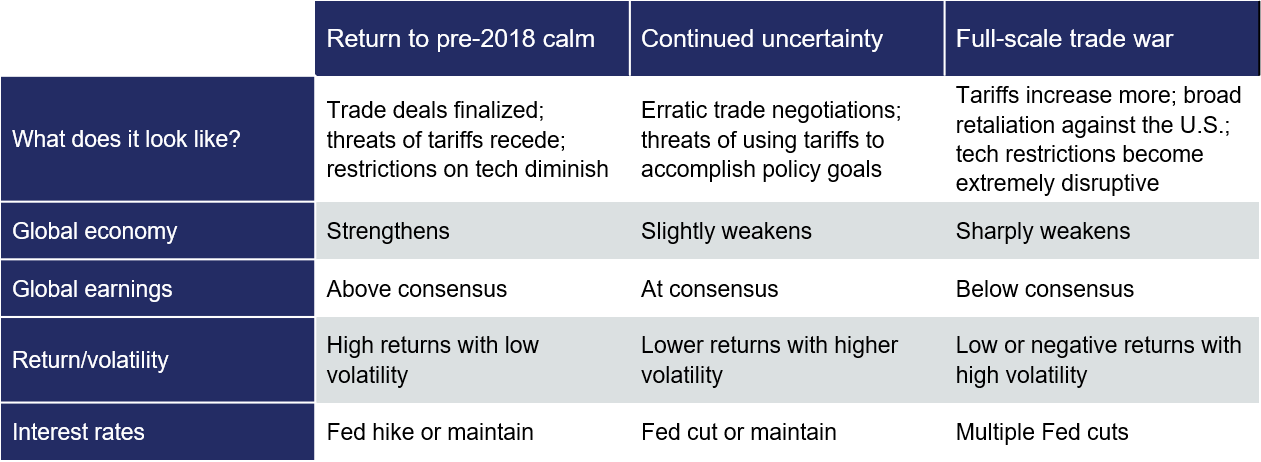

Despite the back-and-forth, will-they-or-won’t-they headlines, the overall health of global trade is becoming clearer [Exhibit 2]. It now seems very unlikely that we will return to the pre-2018 world, where trade uncertainty completely disappears, and the global economy and markets return to a reliable calm. This administration appears willing to use tariffs as a negotiating tool for various policy objectives, from trade to technology to immigration.

Exhibit 2

Because of this, the threats of potential tariffs—and even potential trade wars—will continue to linger, which is important in and of itself, even if no future tariffs are imposed. Broad uncertainty regarding trade is likely to continue to depress business investment and investor confidence, resulting in more market volatility.

The recent market volatility, much of which was driven by trade news, reminds us that headlines (and tweets) can often cause short-term swings in the market. But it’s important to note that, as we’ve seen, these swings can go both ways. Just as quickly as markets fall due to rumors of new tariffs, they can rebound quickly on the hopes of an impending deal.

As we like to remind our clients, we can’t predict which way the wind will blow—and we don’t believe anyone else can either. Fortunately, that’s not necessary for a successful investment experience. In the midst of market shifts, we continue to dynamically rebalance client portfolios in order to maintain our chosen investment strategy. But we don’t make investments based on a hunch about world events, especially when those world events are so contingent upon politics. We are long-term investors who get comfort from decades of data that show that, although trade wars might temporarily disrupt performance, remaining consistent and patient is what matters in the long run.